Fiscal instability slowing recovery, driving away investors

Billy Tsuma

For any investor, the most important factor to consider when choosing an investment destination is policy stability and predictability.

The two aspects earn investors’ trust and build confidence. What happens when the business environment is highly unpredictable and unstable?

The Covid-19 pandemic forced some companies to completely shut down, causing governments to grapple with revenue shortfalls.

They had to borrow heavily to cater for the ballooning health bill. Countries also faced supply chain disruptions due to the measures put in place to mitigate the spread of the virus.

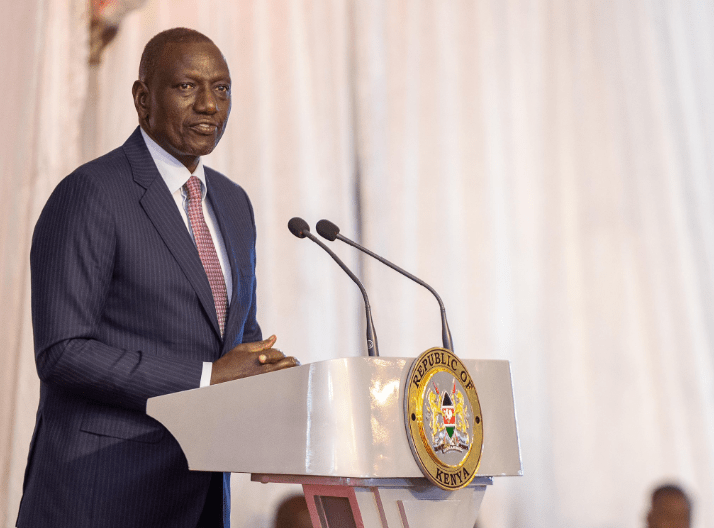

The contribution of Kenya’s manufacturing sector to the country’s GDP remains low. It is, therefore, critical that we focus on strengthening the industry.

However, the current policy and fiscal regimes are pulling us back in the quest to become an industrialised nation.

The increase in the tax rates implemented through inflation adjustment for excisable goods has driven up the cost of locally-manufactured goods, which have now become less competitive.

Such measures increase the cost of doing business and deter investors from setting up businesses in Kenya.

There is an even graver risk that our policymakers will create an economic environment that is hostile to business recovery and investment if they continue to use shock tax rises to fill the fiscus.

A key driver of growth in the manufacturing sector is Foreign Direct Investment (FDI). Quality FDI creates jobs, develop the host economy’s skills base, provide a platform for technology transfer and boost competitiveness.

An unstable economic environment drives away FDI and hinders a country from enjoying the benefits. This has been the case in Kenya, with FDI reducing over the years.

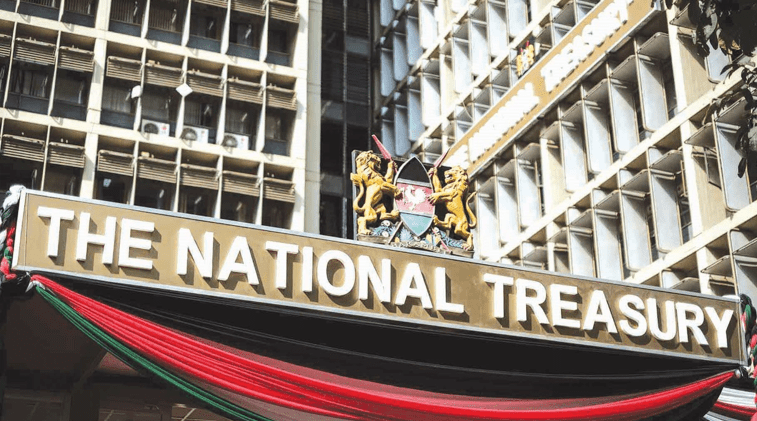

The 2021 World Investment Report by the United Nations Conference on Trade and Development shows FDI into Kenya has halved since 2017. At the time, Kenya ranked in the top ten for investment in Africa. Currently, we are ranked 16th.

There is a mounting gap between Kenya and those at the top of the rankings. We currently win just 1.8 per cent of FDI into Africa, with Egypt attracting 14.7 per cent.

In East Africa, we are performing at a fraction of the rate of our regional counterparts, with countries such as Ethiopia accounting for 37 per cent of inflows in the region versus our 17 per cent. FDI in Ethiopia is driven by manufacturing, agriculture and hospitality industries—areas where Kenya has immense potential to compete.

The reason for this downward trend is that the regulatory and fiscal environment has become increasingly unpredictable.

In November, Kenya Revenue Authority increased excise taxes through the 4.97 per cent inflation adjustment. The move has, however, been put on hold by an order of the High Court, pending determination of a case earlier filed.

Excise tax patterns in Kenya are becoming increasingly erratic. The tobacco industry has incurred massive cumulative shock excise increases of about 50 per cent in recent years.

Our cigarettes have far higher taxes than in neighbouring countries, which incentivises cigarette smuggling and costs the government approximately Sh4 billion every year. Currently, about a quarter of cigarettes sold in Kenya are illicit, compared to one in 100 in 2015.

Attempts to introduce a 25 per cent excise tax on imported glass and furniture were suspended by the court in January.

The proposed taxes were deemed discriminatory, risked ruining Kenya’s international relations and would further burden taxpayers.

While the attempts to throw taxes onto imports failed, the reputational damage to Kenya has already been done.

The policies send a clear message to investors seeking tax certainty that Kenya’s fiscal policies are unpredictable—the results of which can be found in our falling FDI receipts.

Kenya needs to do better for business. Tax certainty will not only help to repair our reputation as a leading home for FDI in Africa but also support local manufacturers in their path to recovery and sustainability.

The manufacturing sector has its role in funding Kenya’s recovery but unless the government widens the tax pool by attracting inward investments, it runs the risk of back-tracking economic recovery plans.

— The writer is an advocate of the High Court of Kenya and chair of the KAM’s Anti-illicit Trade Sub-Committee and the Anti-Illicit Trade & Fiscal Affairs Engagement manager at BAT Kenya