Tax shock for hustlers in new housing bill

Non-salaried Kenyans—what President William Ruto fondly describes as hustlers—will now pay 1.5 per cent of the gross income from their businesses as housing levy following the passing of the Affordable Housing Bill.

However, the bill will be subjected to another hearing by the Senate for concurrence before the President assents to it. A bill involving counties must be approved by the Senate.

There is a likelihood it will sail through the Senate where Kenya Kwanza enjoys a majority.

The revised Affordable Housing Bill passed by the National Assembly means gross income earned by people outside formal employment will also be taxed to support Ruto’s pet project.

The changes were necessitated to address an illegality pointed out by the Constitutional Court which cited the singling out of salaried people as discrimination amounting to a constitutional violation, in a ruling rendered on November 28.

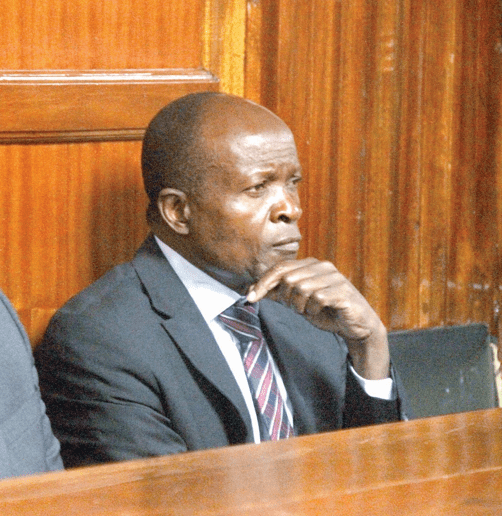

Justices David Majanja, Christine Meoli and Lawrence Mugambi argued that by singling out the formal sector without justification, the law failed to conform to the principle of non-discrimination.

“The levy against persons in formal employment to the exclusion of other non-formal income earners without justification is discriminatory, irrational, arbitrary, and against the constitution,” Justice Majanja declared.

If approved by the Senate, the law will establish the Affordable Housing Fund where monies collected under the Affordable Housing Levy will be held under the supervision of a board.

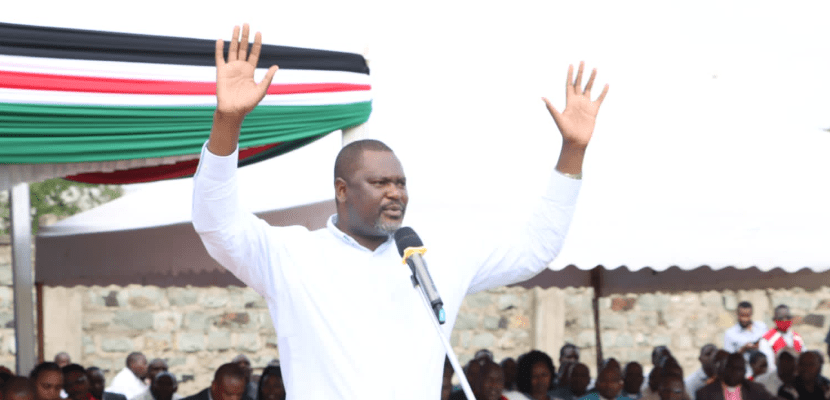

Responding after the passage of the bill, Leader of Majority Kimani Ichung’wah said it was about employment creation, wealth creation, helping Kenyans to access affordable homes, creating new homeowners and therefore generating new wealth and growing the economy.

“The mama mbogas, boda boda riders, and Jua Kali artisans will now participate fully in the programme by contributing to the Levy as directed by the court,” Ichung’wah said.

“I am happy that we have a President who has chosen to do not what is politically expedient, not what is popular but what is right for this country. He has chosen to do what is good for millions of our young people who have no jobs,” added the Kikuyu MP.

Rarieda MP Otiende Amollo, however, differed and questioned why the Housing tax was being imposed on gross earnings instead of net. The bill, he added, is also vague on how the houses will be shared or distributed.

“The new tax will further hit the overtaxed Kenyan, we proposed that the Housing tax be imposed on the net and not the gross pay,” Amollo said.

Marginalised

Nominated MP John Mbadi said the bill was exposing Kenyans, including mama mboga who were promised that this levy will only affect those who are salaried and have a payslip to unnecessary harassment by KRA.

“To impose this levy on people who don’t have a salary is going to be a nightmare,” said Mbadi. “There is something that worries me about this Bill. In an effort by the Executive to correct what was said in court, they are creating a bigger problem for the people of Kenya.”

Those who misappropriate the Housing Fund will face punitive sentences after MPs approved a Sh10 million fine.

There will also be harsh penalties for non-remission of the levy set at 3 per cent of the unpaid amount for each month in arrears.

Unlike the first bill, the new one gives the marginalised persons preference in the allocation of houses. This category includes those residing in slums and persons with disability.

The bill clustered affordable homes into three; social housing, affordable housing and affordable market housing.

On Tuesday, pro-government MPs won a vote that was seeking to stop debate at the Second reading stage pending the determination of a myriad of issues raised by the Minority leader Opiyo Wandayi.

Amollo and Mbadi protested that the bill had many gaps that needed to be addressed before being subjected to the Third reading.

Amollo said as the national government endeavours to push for the passage of the bill, and no matter how well-intentioned the government may be, housing is a county government function.

Chairman of the Finance and Planning Committee Kimani Kuria said one of the amendments that his team will be moving is a provision that all the transfer of land from public to private will have to follow the Lands Act.

“On the issue of penalties, in terms of the time when these levies are levied to the relevant authority, we will also be promoting an amendment so that they are in line with the Tax Procedures Act so that the fines and penalties that shall accrue as a result of late disbursement will follow the rest of the taxes as enshrined in the Procedures Act,” Kuria explained.

Although the Affordable Housing Bill, initially presented as a National Assembly Bill, must undergo Senate scrutiny for consensus, this process is expected to prolong the timelines for implementing the housing fund deductions.