Government takes Sh10b loan every month – Treasury

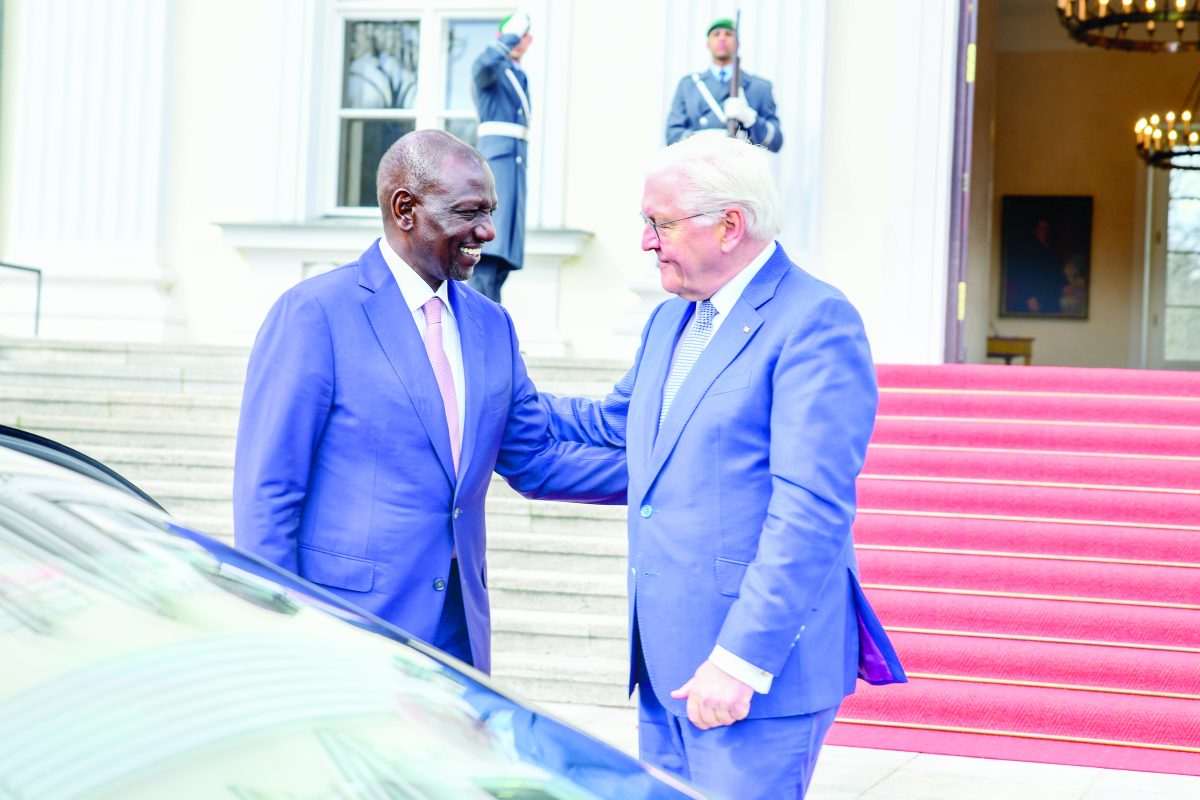

By Mercy.Mwai, March 28, 2023President William Ruto’s administration borrowed Sh10.9 billion every month from September 1 to December 31 last year to finance various developments.

A document presented to Parliament by National Treasury Cabinet Secretary Prof Njuguna Ndung’u shows that in four months, the government contracted eight new loans at a total cost of Sh43.4 billion whose repayment period ranges from the year 2030 to 2047.

The new loans bring the total amount the government has borrowed from January 1 to December 31, 2022, to Sh286.39 billion after two reports released last year showed that between January to April, the government signed six global loans amounting to Sh137.93 billion while between May 1 to August 31, the government borrowed loans worth Sh105 billion.

The document tabled before the National Assembly by Deputy Leader of Majority Owen Baya revealed that the loans have been contracted between the Kenyan government, and commercial bilateral and multilateral creditors.

“This section contains eight new loans contracted between the government of Kenya and bilateral, multilateral and commercial creditors. The total value of the eight loans signed is equivalent to Sh43,381,450,293. Two of the loans had been disbursed by the time of submitting this report” reads the document.

The tabling of the report is in line with the Public Finance Management (PFM) Act that mandates the National Treasury to periodically update Parliament on the country’s debt status

The report indicates that the proceeds of the loans will be used to finance various government projects such as water projects, food and nutrition security, maternal health informal sector improvements as well as the Small and Medium Enterprises (MSMEs).

The report comes at a time when the new administration is grappling with a huge public debt that has been growing since 2013 when former President Uhuru Kenyatta’s Jubilee administration came to power.

Currently, the country’s public debt stands at Sh9.1 trillion against a ceiling of Sh10 trillion enacted by Parliament in May last year. By the time the Jubilee administration was coming to power in 2013, the country’s public debt was at Sh1.8 trillion.

“At the end of every four months, the Cabinet Secretary shall submit to Parliament stating the loan balances brought forward, carried down, drawings and amortizations’ on new loans obtained from outside Kenya or denominated in foreign currency,” Section 31 (3) of the PFM Act states.

The National Treasury document shows that of the said funds, Sh2.7 billion procured from the Mizuho Bank Europe NV will be used for Turnkey medical equipment and refurbishment package contract to upgrade maternal and newborn units of 20 sites. “The purpose of the loan is to finance amounts payable to the exporter under the Export Contract in respect of eligible goods and services,” adds the report.

To increase the sustainability access and management of groundwater in the Horn of Africa’s borderlands the government signed a Sh16.7 billion loan from the International Development Association.

“The loan will be repaid in 40 equal semi-annual repayments. The interest rate of the loan is 1.25 per cent per annum and the service charge is 0.75 per cent per annum on the withdrawn credit balance,” reads the report.

To support programmes to build resilience for food and nutrition security in Djibouti, Kenya Somalia and South Sudan the government has signed a loan of Sh5 billion from the African Development Fund which shall be paid over a period of 30 years after the expiry of the grace period.

The money will be used to contribute to resilience building including for women and youth, food and nutrition insecurity and climate change and peace and security in the horn of Africa.

“The specific objective of the project is to increase sustainable productivity and agropastoral systems, increase incomes from agropastoral value chains and enhance adaptive capacity for the people to prepare for and manage climate change risks and variation,” adds the report.

The government also signed another Sh2.5 billion from the Federal Republic of Germany to finance goods and services in order to improve waste and water management in Kisii and Kericho.

“The loan will be repaid in 60 equal semi-annual instalments of euro 300,000 from May 15, 2033, to November 15, 2062. The interest rate of the loan is 0.75 per cent per annum on the disbursed loan amounts. The commitment charge rate is 0.25 per cent per annum on undisbursed loans,” adds the report.

To increase rural financial inclusion and green investments by agriculture value chain stakeholders, the government secured a Sh2.59 billion from International Fund for Agricultural Development (IFAD).

The funds will also be used to create equitable employment opportunities, and innovative and resilient production systems as well as increase incomes for smallholders, poor and marginalised rural households, women and youths.

In addition, the government also secured Sh3.6 billion loaf from the Federal republic of Germany to help establish a centre for entrepreneurship including satellites together with an integrated voucher system and primarily to pay the foreign exchange costs. To support food security and employment in Western Kenya through local resilience projects, the government secured a Sh4.2 billion from the federal republic of Germany.

“The purpose of the loan is to finance performance-based grants to counties in Western Kenya to plan, implement and monitor climates resilient investments with a focus on agriculture-related activities and youth as well as national-level activities that strengthen national governments capacities to manage climate risks,” adds the report.

To support the second Kenya Informal settlements improvement project, the government borrowed Sh6.2 billion from Agence Francaise De Development which will be repaid in 26 equal semi-annual instalments.