Azimio pushes back on Finance Bill amendments

In a significant response to public pressure and opposition efforts, the Kenya Kwanza government has made notable revisions to the Finance Bill 2024.

The amendments follow widespread criticism of the original proposals, which were seen as excessively punitive and insensitive to the needs of the Kenyan populace.

Azimio la Umoja coalition has lauded the public's role in driving these changes.

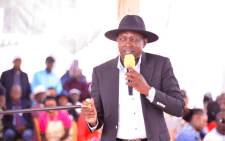

“We take this opportunity to thank all our members who have expressed strong objections to the proposals that were as punitive as they were insensitive,” Opiyo Wandayi, National Assembly Minority Leader who also servers as Ugunja MP, said in a statement on Tuesday, June 18, 2024.

The coalition acknowledged the power of citizen activism, particularly a strong social media campaign that pressured lawmakers to reconsider the Bill's provisions.

Despite the amendments, Azimio la Umoja remains sceptical of the government's intentions.

Wandayi suggested that some of the initial proposals were designed to incite public outrage, only to be retracted later to create an illusion of responsiveness.

“There was never any justification for proposing to increase tax on bread or to tax sugarcane delivered to factories. The Motor Vehicle tax was outrageous from the start,” he said.

Wandayi criticized the government for what he described as governing through mind games.

Taxes, levies scrapped

Key amendments to the Finance Bill include the removal of VAT on bread, sugar transportation, financial services, and foreign exchange transactions.

Additionally, the proposed 2.5 per cent Motor Vehicle Tax has been scrapped, and excise duty on vegetable oil has been eliminated.

The Eco Levy will now only apply to imported finished products, exempting locally manufactured goods such as sanitary towels, diapers, phones, computers, tyres, and motorcycles.

The excise duty for alcoholic beverages will be calculated based on alcohol content rather than volume, encouraging the production of safer and more cost-effective beverages.

Pension contribution exemptions from tax have been increased from Ksh. 20,000 to Ksh. 30,000 per month. The VAT registration threshold has been raised from KSh5 million to KSh8 million, easing the tax burden on small and medium-sized businesses.

More revisions needed

Despite these changes, Azimio la Umoja insists that further revisions are necessary.

The opposition coalition demands the elimination of the Export Promotion Levy of 10 per cent on clinkers for cement manufacturing, arguing that it stifles competition and unfairly benefits a specific investor.

The coalition also opposes the Transport Ministry’s proposal to increase the fuel levy by Ksh9 per litre, emphasizing the critical role of transportation in the economy.

Azimio argues that the fuel levy will still make life hard for Kenyans.

"We also demand the outright dropping of the proposal by Transport CS to increase fuel levy by Ksh9 per litre. We are against this idea that transport, which includes the movement of goods and people is some kind of luxury that this country can do without. Without movement of goods and people, we have no economy to talk about. Our position is that there shall be no more ad hoc raising of prices of fuel," Wandayi said.

The Minority Leader added that Azimio would continue to poke holes in the revised Finance Bill 2024.

“We will scrutinize the Bill more accurately and demand amendments to more areas as they emerge,” said Wandayi.

He affirmed the coalition's commitment to representing the electorate and safeguarding the country's economic health.

For these and more credible stories, join our revamped Telegram and WhatsApp channels.

Telegram: https://t.me/peopledailydigital

WhatsApp: https://whatsapp.com/channel/0029Va698juDOQIToHyu1p