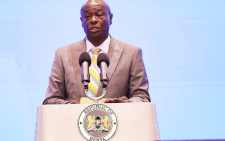

In what could be a major setback to shareholders, a deal that would have seen Equity Bank Holding (EBH) acquire shares in four of Atlas Mara Ltd (ATMA) subsidiaries and increase its footprint within East and Central Africa, has been put on hold, the group managing director and chief executive James Mwangi has said.

Last April, Mwangi said EBH had entered into a non-binding agreement to invest 62 per cent in Rwanda’s Banque Populaire du Rwanda Plc, take over Zambia’s African Banking Corporation, Tanzania’s African Banking Corporation Tanzania Ltd and Mozambique’s African Banking Corporation.

Transaction agreement

It has, however, temporarily fallen through, with Mwangi explaining that the parties were yet to sign detailed transaction agreements and that the Binding Term Sheet had expired.

“However, EGH and ATMA expect to continue further discussions in early-2020 to try to reach mutually acceptable commercial terms with respect to the proposed transaction, or a variant of it,” he said, adding that EGH will make further announcements upon conclusion of any fresh binding transaction agreements.

“Until further announcements regarding the proposed transaction are made, the shareholders of EGH and other investors are advised to exercise caution when dealing in EGH ordinary shares on the Nairobi Securities Exchange, the Uganda Securities Exchange and the Rwanda Stock Exchange,” said Mwangi.

“I think it would be disappointing if the deal is dead for Equity Bank shareholders because it was facilitating a material geographical extension. Obviously someone is playing hardball but I am not sure whom,” said Aly Khan Satchu, an analyst and stocks dealer

If the share swap comes through, it will see Equity allot about 252.5 million new ordinary shares representing about 6.27 per cent of Equity’s issued shares, equivalent to Sh10.7 billion.