Central Bank of Kenya (CBK) have been urged to cut the base rate to 10 per cent, with economists arguing high rates amid low inflation is stifling growth and recovery. They reckon that the current CBR of 13 per cent lags behind the recent downward trend in inflation, and that maintaining this high interest rate in the face of subdued inflation is unjustified and counterproductive, as it fails to stimulate economic growth and support the ongoing recovery efforts. Inflation has stabilized within the CBK target range of 2.5 per cent to 7.5 per cent with a mid-target range of 5 per cent.

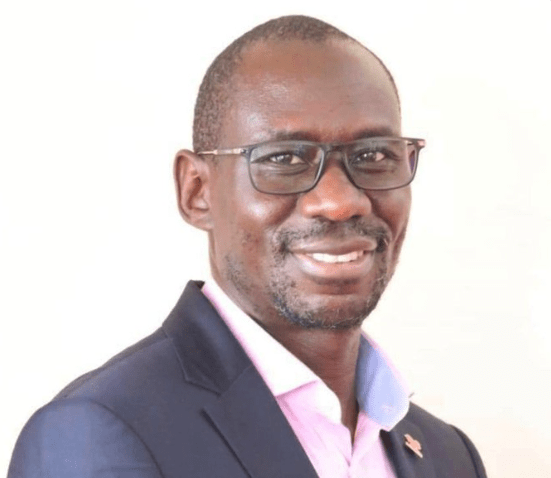

Churchill Ogutu, an economist at IC Group, an African focused investment bank told the Business Hub that CBK has been lagging behind the current inflation trends, which though showing signs off easing, the regulator has maintained high interest rates.

Ogutu sees this approach as backward–looking, as the regulator is acting on past inflation data, rather than being proactive and responding to the expected future inflation trajectory. The current inflation rate is 4.60 as of June 2024, a decrease from 5.10 per cent in May and is expected to be around 5.30 per cent by the end of the quarter.“Based on that, I can argue that the CBR rates are behind the curve. Two, look at the inflation outturn even now. It has come back to target level. It therefore solidifies the argument that the next meeting (MPC) next month should be a cut,” Ogutu said. The MPC is due to meet next month.

He said reducing the base rate can help filter through to the broader interest rate environment, which he described as “quite crazy” and signal to the market that rates need to come down, allowing for a more stable and predictable interest rate regime that supports economic recovery.

According to Ogutu, the CBK faces a dilemma on the extend of the rate cuts, weighing whether to cut before the US Federal Reserve bank (Fed) and potentially raise it later, or cut now regardless of the Fed’s action, in order to asset its independence and address domestic economic conditions.

The consensus view is that the Fed is poised to begin cutting interest rates in September 2024, with the possibility of additional cuts in the following months as it shifts its focus to supporting the labour market alongside its inflation fighting efforts. “That is where the CBK finds itself in. But to be more independent, probably they need to be skewed towards a cut, whichever quantum, at least to be able to show the independence and also they are looking at what is happening in the domestic economy,” Ogutu said.

Moreover, Ogutu, who was speaking Tuesday, on the sidelines of the sidelines of the launch of the Institute of Economics Affairs of Kenya (IEA-K) macro-economic study since 2021 said the Kenyan shilling had appreciated significantly, reaching levels of Sh130, and that further appreciation could lead to Sh125 or Sh120, potentially harming the economy. He argued that a reduction in the CBR would help stabilize the exchange rate and provide a buffer against external shocks.

“We have seen the Kenya shilling appreciate by 20 per cent, reaching the levels Sh130. There is no justification for the currency to appreciate further beyond this point. If the shilling were to appreciate even more, we could see it reach Sh125 or even Sh120, which could be detrimental to the economy,” Ogutu said.