The Monetary Policy Committee (MPC) of the Central Bank of Kenya (CBK) has held the Central Bank Rate (CBR) steady at 13 per cent, a decision influenced by a mix of global and domestic factors.

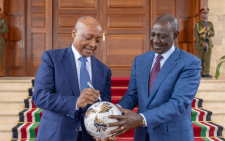

According to Governor Kamau Thugge (pictured), the global economy continued to recover, bolstered by strong growth in the United States and resilience in emerging markets, particularly India, noting that geopolitical tensions and the prospect of prolonged high interest rates pose significant threats to the growth.

“While global inflation has moderated, it remains stubborn in advanced economies,” he said. Domestically, Thugge said Kenya’s inflation rate has remained stable, registering 5.1 per cent in May 2024, compared to 5 per cent in April.

This stability is within the target range, with food inflation at 6.2 per cent due to supply disruptions from heavy rains and flooding. However, prices of non-vegetable food items like maize, sugar, and wheat flour have declined due to improved supply. Fuel inflation also saw a decrease, reflecting lower pump prices and electricity costs.

“The MPC concluded that the current monetary policy stance will ensure that overall inflation remains stable around the mid-point of the target range in the near term, while ensuring continued stability in the exchange rate. Therefore, the Committee decided to retain the Central Bank Rate (CBR) at 13 per cent,” Thugge said in a statement.

The MPC noted that its previous measures have successfully brought overall inflation to the mid-point of the target range and stabilized the exchange rate.

However, Non-Food Non-Fuel (NFNF) inflation has remained sticky, and interest rates in major economies are expected to remain high due to persistent inflation.

The MPC said the decision to retain the CBR at 13 per cent would to ensure that overall inflation remains stable around the mid-point of the target range in the near term.