Trading at NSE slows down ahead of end-year festivities

Trading activities on the Nairobi Securities Exchange (NSE) fell sharply last week as investors closed their books ahead of the December festivities.

Equity turnover decreased by about 41.53 per cent to Sh2.31 billion from Sh3.95 billion in the preceding week, while shares traded declined by 38.3 per cent, marking a drop in trading activities as players took their eyes off the counters.

The bonds market was also affected as the Christmas mood weighed down on the Nairobi bourse, decreasing by 33.68 per cent to close the week at Sh9.79 billion from Sh14.77 billion in the previous week.

“The NSE 20-share Index closed the week lower at 1,854.55 points, a 0.1 per cent decrease from the preceding week’s figure of 1,856.45 points,” the NSE’s key weekly market highlights for the week ended December 17 says.

However, the All-share index increased by 0.53 per cent to close the week at 163.64 points from last week’s figure of 162.77 points, while the NSE 25 Share Index increased by 0.86 per cent to close the week at 3,625.08 points from the previous week’s figure of 3,594.17 points.

The stock market has improved this year after poor performance attributed to the Covid-19 outbreak. The recovery was led by Safaricom and commercial banks whose dividend payouts have helped pull investors back to the market.

Last week, Nairobi Business ventures and Sameer East Africa were the highest gainers rising eight per cent and four per cent respectively as Kengen and KenyaRe lost due to selling pressure.

The local currency is also expected to strengthen as demand for international imports fizzles out of the market with most traders taking a retreat to celebrate the season.

The shilling last Friday stabilised at Sh112.9 to the US dollar has depreciated by over three per cent this year, according to Central of Bank of Kenya data.

Money market was relatively liquid during the week ending December 16, supported by government payments, which partly offset tax remittances. Commercial banks’ excess reserves stood at Sh4.6 billion in relation to the 4.25 per cent cash reserves requirement. Open market operations remained active.

Interbank deals

The average interbank rate was 4.62 per cent on December 16 compared to 4.60 per cent on December 9.

During the week, the average number of interbank deals per day increased to 31 from 18 in the previous week, while the average value traded increased to Sh 18.1 billion from Sh5.0 billion.

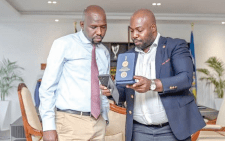

Rising Covid-19 infections spawned by fears of Omicron variant raised fears that the government may need to restore containment measures that could affect businesses activities but Health Cabinet Secretary Mutahi Kagwe allayed the fears.

Speaking on the sidelines of a consultative meeting with the Council of Governors on addressing health policy and legislative barriers, Kagwe said Kenyans do not need to panic.

“As you all know that we started the process of ensuring that persons arriving in Kenya, particularly from South African countries, get tested at the airports. We have been sequencing some of the samples that we have collected and I can confirm that we have actually detected the Omicron variant among the travellers,” he said.

However, despite the detection of the new variant, which is spreading at an alarming rate, Kagwe ruled out any lockdowns any time soon as a measure to stop the spread.

“So far, we are not announcing curfew or any lockdowns. We have seen some countries that have gone into emergency lockdowns, but for us we are still observing,” he said.