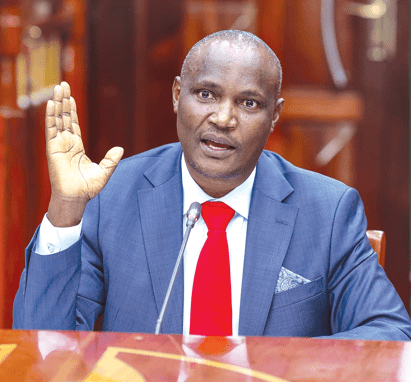

Tough choices for Mbadi to maintain fiscal balance

The newly appointed Treasury and Economic Planning Cabinet Secretary John Mbadi faces the formidable task of mastering fiscal management to allocate budgetary resources effectively and enhance public service delivery, all crucial for spurring Kenya’s economic growth, according to experts.

As Mbadi steps into his role, he must quickly address key issues hindering economic progress. These include implementing sound fiscal policies, cost-cutting measures, tax reforms, public debt management, and debt restructuring to ensure economic sustainability.

Economist Stephanie Kimani emphasised the need for the new CS to prioritise a fiscal management policy that directs resources to the most critical sectors. Following the collapse of the Finance Bill 2024, Mbadi is expected to reassess tax measures to stabilise the economy.

Earlier this year, major budget cuts affected vital sectors. The health sector saw a reduction of Sh20 billion, and the education sector experienced a Sh30.34 billion cut with the school feeding programme completely eliminated.

Speaking during a podcast hosted by Mwango Capital, Kimani suggested that Mbadi should focus on slashing non-essential government expenditures and unnecessary administrative costs, to ensure more efficient use of public funds.

Travelling allowance

“I will always be on the front of slashing non-essential government expenditure, such as travelling allowance, and unnecessary administrative costs and dissolve unnecessary offices which will, in my opinion remain crucial in terms of money expenditure, at least what can be in their control,” Kimani suggested

Tax policy remains another area of concern. Kenya’s tax policies have been under constant review, creating unpredictability that hinders the ease of doing business. Ruth Kendagor, Head of Research at the Institute of Public Finance, warned about the frequent reversals in tax measures, which disrupt business planning and discourage investment.

“So, predictability really affects business planners. Say, for instance, you are investing in the hotel industry or the hospitality industry and the Finance Bill 2023 had given you a particular benefit in terms of tax exemptions or subsidized rates for you to put in your investment,” Kendagor explained.

When businesses plan investments based on tax benefits outlined in one Finance Bill, only to have those benefits revoked in the next, it creates uncertainty that can lead to reduced investment. This unpredictability, she noted, has led some businesses to scale back operations.

Despite these challenges, the government’s introduction of the Medium-Term Revenue Strategy has been praised. The strategy aims to boost Kenya’s tax revenues by increasing the revenue yield from the current 13.5 per cent of gross domestic product (GDP) to at least 20 per cent by the end of the financial year 2026/27.

Kendagor advised that Mbadi should prioritise the implementation of this strategy, ensuring it doesn’t become another unused policy document. Instead of focusing on introducing new taxes or increasing tax rates, Kimani said Treasury should enhance the tax collection mechanism and broaden the tax base. Utilising digital tax systems could minimise tax evasion and optimise compliance, leading to increased government revenues.

Public debt management is another critical area where experts believe Mbadi should focus, particularly on the issue of debt rescheduling. Last year, Kenya faced the challenge of a Eurobond due for repayment, which was rescheduled to 2029.

Debt rescheduling

Kendagor noted that while debt rescheduling can provide temporary stability, it must be done within a framework that promotes economic growth.

She warned that without addressing issues like wastage, corruption, and financial leakages, debt rescheduling could place an additional burden on citizens.

“In other countries we have seen that debt rescheduling may give the country a sort of stability but in Kenya, as long as we continue having problems with wastage, corruption, and leakage, our rescheduling process will happen, but it will happen in a problematic manner. It will affect citizens because of the extra burden, and any additional cost that comes with it,” Kendagor said.

She emphasised the need for transparency and strategic investment in growth sectors to ensure this would ensure that the resources generated from these sectors could be used to pay off the rescheduled debt, thereby reducing the financial strain on the country.