State on borrowing spree as new foreign loans hit Ksh 898b

Kenya’s borrowing spree has continued unabated having secured 36 new foreign loans amounting to Sh898 billion in the 2023-2024 fiscal year. Of these, 27 loans were sourced from multilateral lenders, six from commercial banks, and three from bilateral lenders, says a new report by Africa Centre for Open Governance (AfriCOG)

Principal repayments exceeded half a trillion shillings in the past year alone, with Sh330 billion due in 2024. The repayment outlook remains daunting, with over Sh1.5 trillion scheduled to be paid to foreign creditors between 2025 and 2027, indicating Kenya’s predicament. Speaking during the event, AfriCOG Executive Director Gladwell Otieno took issues with the government saying that it does not consult the public or inform them about the debt details.

“Even Parliament is kept out of the loop. The principle of ‘no taxation without representation’ implies ‘no borrowing without representation’. Parliament must use its authority to control the Executive’s appetite for debt contracting and ensure the reduction of foreign loan costs,” Otieno said. As of September 2024, the Central Bank of Kenya reported that the public debt stood at Sh10.8 trillion.

AfriCOG echoed World Bank remarks advising countries to improve debt transparency at the national level by providing an annual year-end loan-by-loan account of outstanding balance and transactions for all external public and publicly guaranteed debt.

Data from the International Debt Report estimates that Kenya’s external debt stock hit Sh5.55 trillion in December 2023, an equivalent of 35 per cent of the national gross domestic product, which currently stands at Sh14.6 trillion.

Over half of the external debt (55 per cent) is owed to multilateral creditors led by World Bank with 30 per cent and Africa Development Bank with 10 per cent.

Bilateral creditors come second with their 23 per cent share with China being the largest creditor in this category with 16 per cent followed by Japan and France with 3 and 2 per cent respectively.

The report published by the World Bank further showed that private creditors hold 22 per cent of the total debt out of which 18 per cent is owed to bondholders and another 3 per cent came from commercial entities.

However, World Bank’s data showed that for the last five years, Kenya borrowed the least from the private creditors in 2023, although the interest rate drastically increased from 6 in 2022 to 10 per cent in 2023. Additionally, their loan maturity period decreased by half from 11 years in 2022 to five years in 2023.

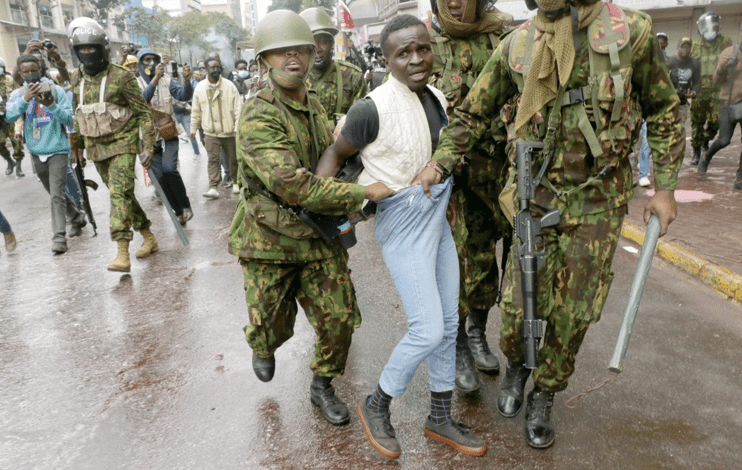

In 2023, Kenya accessed most of its external loans from official creditors, with a maturity period of about 18 years and an interest of 4 per cent. The country’s financial challenges were exacerbated by the rejection of the 2024 Finance Bill which had spelt out a raft of taxes which would have enabled the government to raise additional revenue, partly to service local and international debt.

To keep going, the government would spell out austerity measures in all its operations but five months down the line, the country is still in fiscal turmoil. The global lender advised developing countries to get loans from official creditors, which have favourable terms, compared to private creditors.

“In 2023, developing countries spent a record $1.4 trillion just to service their debt. That amounted to nearly 4 per cent of their gross national income. Ballooning interest payments accounted for most of the increase in overall debt-service payments. Principal repayments remained stable at about $951 billion, but interest payments surged by more than a third to about US$406 billion,” World Bank said in the report.

Consequently, many developing countries started to divert resources away from critical sectors for long-term growth and development such as health and education.

“The squeeze on the poorest and most vulnerable countries—those eligible to borrow from International Development Association (IDA)—has been especially fierce. Their interest payments on external debt have quadrupled since 2013, hitting an all-time high of $34.6 billion in 2023,” the report stated.