State mulls comeback of price stabilisation levies

The government is contemplating reintroducing levies for key export commodities as part of a deal to guarantee price stability.

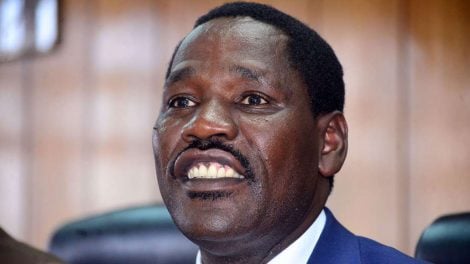

Agriculture Cabinet Secretary Peter Munya early this week said the ministry is keen to re-establish levies in coffee, tea and sugar in order to support undertakings of other activities in the key foreign exchange earners.

In a turn of events, this would mean the return of development levies which were removed some years back, following outcry from various stakeholders.

“The funds targeting specific commodities will act as subsidies which to a large extent can finance acquisition of farm inputs and promise stable prices throughout the year.

This is a stabilisation mechanism Government is determined to establish as a strategy to shield farmers against price volatility,” said Munya.

Tea exports

Legal Notice 104 of 2016 revoked the Tea (Ad Valorem Levy) Regulations, 2012 which imposed an ad valorem levy of 1 per cent on the customs value of all tea exports and import affecting tea farmers and traders.

The removal of the levy was meant to make Kenya’s tea competitive on the global market by pushing down its prices.

Further, the removal of sugar development levies through Legal Notice 103 of 2016 was also revoked the The Sugar (Imposition of Levy) Order, 2002.

The new subsides according to Munya are meant to ensure the value chain pay a levy to ensure farmers continue enjoying sustained income.

This stabilisation funds come at a time when prices at Mombasa tea auction have continued to decline since early June.

The task-force which was appointed by Munya last year is in the final stages of presenting a report detailing the design, development and implementation of the tea industry price stabilisation framework.

Development levies will equally be established in coffee and sugar with the same highlighted in legislative bills already at different stages of progress in parliament.

Early this week the CS indicated that the tea task-force is almost concluding its work and thus will present a comprehensive on how prices can be tamed for the benefit of the farmers.

“The establishment of the price stabilisation fund will target secondary players, mainly the traders.

They will be required to pay a designated levy annually,” Munya said when he met independent tea producers at a Nairobi hotel early this week.

The 13-member task-force headed by former Planning principal secretary Irungu Nyakera, will be presenting the report soon, to enable the Government move in to guarantee price stability in the industry.

Since early June tea prices have been declining prompting to issue a directive two weeks to Kenya Tea Development Agency (KTDA) to always set minimum reserve prices at the auction.

But immediately farmers set the reserve price, buyers rejected tea worth Sh1 billion though Government and KTDA downplayed it saying there is enough resources to compensate farmers for the time their tea will not be bought.

For example, during last week’s tea auction Sale 28 average price decreased to Sh167.555 ($ 1.55) when compared to Sh179.446 ($1.66) recorded during Sale 27 accounting for a 6.6 per cent drop.

Munya had issued the decree arguing the reserve minimum average tea price should be based on the cost of production, the grade of the tea and a reasonable return to the tea grower.

KTDA Holdings chairman David Ichoho last Monday confirmed that small scale farmers will continue to be paid their monthly payments despite the continued rejection of their commodity by buyers at the Mombasa tea auction.

On phone Ichoho stated that the organisation KTDA board and management has set aside resources from its reserves to pay farmers for the tea that has not been bought at the auction for the last two weeks.

End.

are being employed,” they said.

They said due to unresolved grievances from customers, other airlines zeroed in and addressed the grievances while KQ did nothing.

Customers then moved to the other airlines, therefore making KQ lose volumes of business.

“Kenya holds the established position of East Africa’s leading aviation (aggregate passenger and cargo) hub, but stands to lose this position to Rwanda due to the rapid planned growth of its airline from the Qatar funding and the revival of other regional airlines such as Uganda, Tanzania and Burundi,” KALPA said.

They said that bad decisions made over time by individuals given the responsibility to steer the Company are killing the company.

“It is worth noting that in the face of unilateral decisions and hard stances adopted by KQ Management, Kenya Airways employees have exercised a lot of restraint and discretion by carrying out their duties diligently to keep flying the Kenyan flag high,” pilots said

Fraud drivers

“Of note, malware and App attacks continued to rank highly among the factors that have contributed to the surge in emergent cyber security challenges. This situation underscores the need to continue promoting awareness on the fraud drivers,” she said.

“There is need for continuous vigilance and formulation of mechanisms to promote financial security, not only within the banking sector but also in other sectors that deal with financial technology.”

Kenya Bankers Association chief executive Habil Olaka said there has been a significant shift in bank customers’ preferences for digital services which, according to the Association’s Customer Satisfaction Survey of 2020, stood at 43 per cent.

“While the banking industry’s digital resilience has continued to promote continuity in the financial services sector, rising cases of fraud need to be addressed further through consumer education,” he said.

Another sector which is a low-lying fruit for cyber attacks is the multi-trillion shillings co-operative movement due to its colossal financial resources but with minimal investments in cyber security protection.

According to Kenya Union for Savings and Credit Co-operatives, the growing appetite for digital financial services has seen the sector tap billions which is attracting cyber criminals are every day.