Sacco managers face lawsuits as State streamlines sub-sector

The government has told Sacco managers and directors to play by the rules or risk facing prosecution.

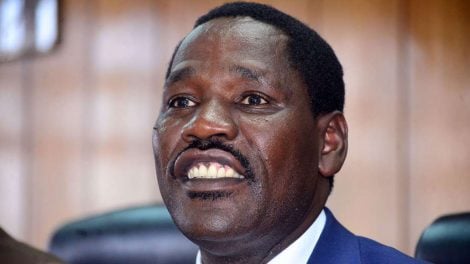

Agriculture Cabinet Secretary Peter Munya said the ministry will push for prosecution of senior official implicated in embezzlement of funds as it streamlines operations of savings and credit co-operatives.

“The government will crack the whip on managers and directors of Saccos, who for selfish personal gains choose such treacherous paths to operate outside law and thus taint the image of the sub-sector,” the minister who is also in charge of co-operatives portfolio said yesterday.

Munya asked the Saccos Fraud Investigations Unit to fast-track criminal investigations relating to fraud, embezzlement and other criminal conducts within the sub-sector, and where criminal culpability is proved, to immediately recommend criminal prosecutions to the Director of Public Prosecutions.

He also called on Sacco Societies Regulatory Authority (SASRA) to henceforth keep and maintain a robust vigilance in the market to ensure there is no Sacco operating outside the regulatory framework,

“Those that do so, must be made to face the full consequences of the law,” Munya said during a breakfast meeting to issue authorisation certificates to non-withdrawable deposit-taking Saccos at a Nairobi hotel.

Speaking on the side-lines of the event, Co-operative Alliance of Kenya CEO Daniel Marube said they are determined to improve the co-operative movement and ensure sound leadership with a view to achieving the standards.

“The new reforms are designed to guarantee confidence to the members who toil every other day to save their hard earned proceeds,” he said.

Munya asked members of the public to stop conducting Sacco business with unregulated entities.

Authorisation certificates

“If you are a member of a Sacco, and your Sacco is not regulated by SASRA, you must ask why.

If the answer is not satisfactory, just do not put your money there,” he added.

During the event, Munya issued authorisation certificates to 25 Non- Deposit Taking Saccos popularly known as Back Office Services Activities (BOSA).

The Saccos will be supervised by SASRA under the Sacco Societies (Non-Deposit Taking Business) Regulations, 2020.

Currently, SASRA regulates about 175 Deposit-Taking Saccos that control assets worth Sh630 billion.

Before the publication of the regulations in May 2020, the BOSA Saccos were not under any form of prudential oversight, other than being generally registered under the Co-operative Societies Act.

This was due to lack of appropriate regulations designed to address the unique business risks associated with them, Munya added.

The legal lacuna, Munya observed, created room for mischief in the public arena by many entities that style themselves as Saccos, collecting savings from members of the public, promising good returns, only to disappear with such savings.