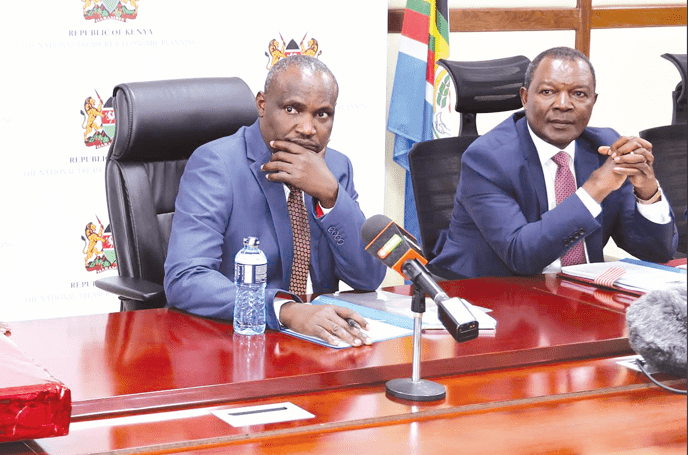

Reforming KRA key to boosting revenue collection, says Mbadi

National Treasury and Economic Planning Cabinet Secretary John Mbadi yesterday emphasised the urgent need for Kenya Revenue Authority (KRA) to adopt innovative and technologically advanced strategies to enhance revenue collection.

Mbadi, who was meeting with the KRA staff, stressed the importance of continuous modernisation in tax administration to streamline business processes, leverage cutting-edge systems, and simplify tax transactions.

“Our modernisation journey must align with our objectives and those of taxpayers. This approach will not only benefit taxpayers but also significantly boost our revenue mobilisation efforts,” the CS said.

Mbadi noted that technology is crucial for reforming taxpayer services, improving operational efficiency, and enhancing revenue collection.

He urged KRA to expand the tax base, particularly in sectors that have traditionally been hard to tax, to protect existing businesses from excessive taxation.

The CS further said that the National Treasury will support KRA by developing policies to guide revenue mobilisation, such as the National Tax Policy, which will support the expansion of the tax base, enhance fairness and equity in the tax system, and create certainty and predictability in tax rates and tax bases.

KRA Commissioner General Humphrey Wattanga announced that KRA is set to revamp its IT infrastructure to establish reliable systems capable of responding proficiently to business demands.

He stressed the importance of modernisation in improving operational efficiency and enhancing KRA’s ability to identify and address potential tax evasion through data-driven decision-making.