Real estate prices record modest growth in Q3

MONEY: Property prices in Nairobi and its environs recorded a modest 0.8 per cent in the third quarter, driven by the detached housing segment that recorded a 1.5 per cent growth.

A HassConsult property research attributes the slow growth to stagnation of apartment sales, whose prices slightly fell by negative 0.3 per cent, over the period.

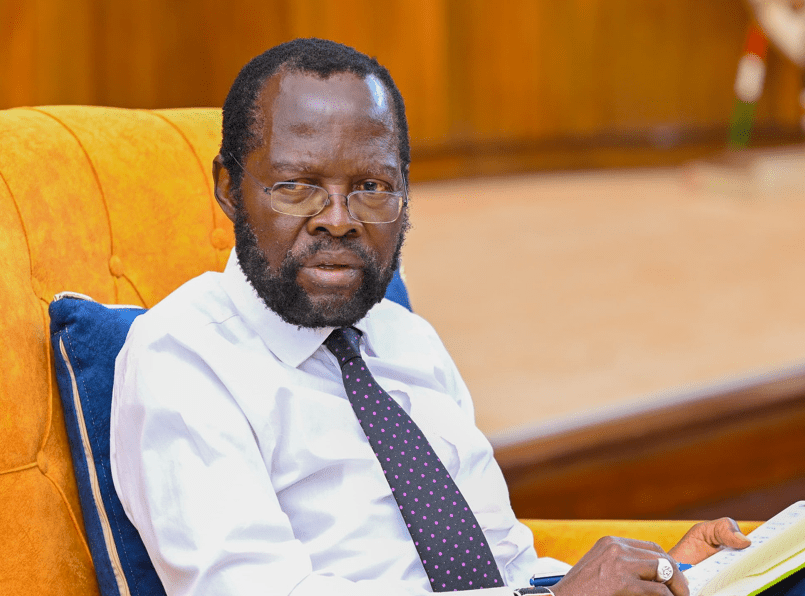

“Apartment market proves most price sensitive with buyers willing to negotiate prices to close on sales,” said Sakina Hassanali (pictured), Head of Development Consulting Research at Hass.

Detached houses, including town houses and villas, maintained demand as seen by the price growth of these units in Loresho and Juja where house prices increased by 3.6 per cent and 5.1 per cent, respectively.

However, apartment prices remained relatively unchanged with a negative 0.3 per cent fall, signalling that sellers in the apartment market are showing more flexibility in asking prices.

“We are in a price sensitive market and owners are taking the hit to sustain sales. Despite this, projects that have excessive demand are increasing prices in line with inflation,” said Hassanali (pictured).

Apartments prices in Riverside dropped by 4 per cent over the quarter while those in Thika dropped by three per cent.

Touch economic times

On the rental front, HassConsult land price indices notes that cost declined across the board by 0.2 per cent reflecting the tough economic environment. However, rent improved in satellite towns, led by houses in Ruiru which recorded a 6.4 per cent increase in asking rents while in the suburbs, Donholm houses recorded the best growth at 2.6 per cent.

The report notes that the Upperhill suburb continues to remain in a period of sustained price drops, as investors’ appetite wanes due to the oversupply of commercial office space in the area. Prices in the suburb dropped by 0.6 per cent over the quarter, sustaining land value price drops since July 2018.

“Upperhill’s continued stagnation is attributed to the office market oversupply in the area that will not see new commercial buildings come through until demand catches up with supply,” said Hassanali.