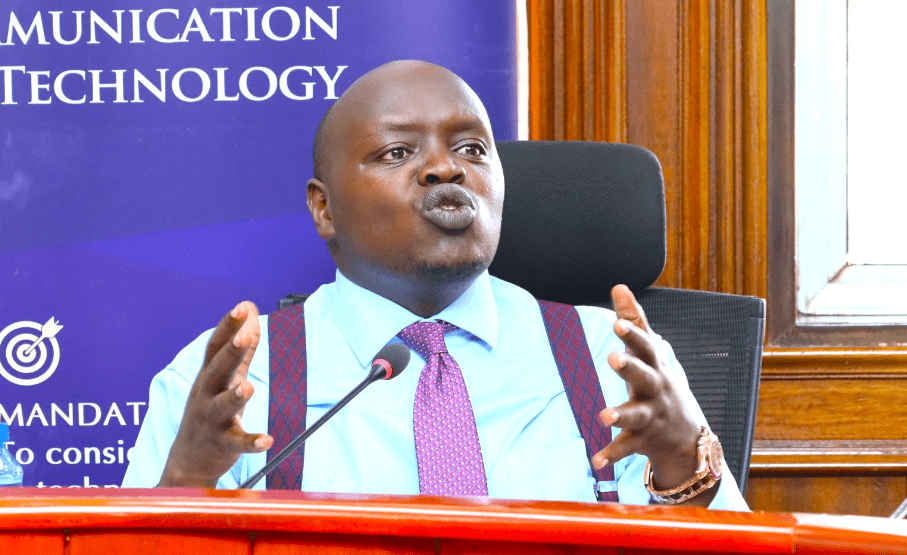

Njoroge warns most SMEs may collapse next month

The Central Bank of Kenya (CBK) has raised the red flag over survival of small and medium enterprises (SMEs) in the next 30 days, saying if they do not get funding, three out of four would have closed shop by next month.

This would cast the economy into deep economic depression given that the sector contributes up to a third of the gross domestic product.

To cushion SMEs, the government needs to execute a credit-guarantee programme to mitigate risks of lending to the sector, said CBK governor Patrick Njoroge yesterday during a post-Monetary Policy Committee virtual press conference.

Njoroge underscored the urgency of implementing the credit guarantee scheme saying most small traders lacked buffers in terms of credit and security, meaning they would easily fold if not urgently assisted.

Dangerous outlook

Citing a survey done at the end of April, the governor warned that three quarters do not have cash.

“So that means by end of June this three-quarters would be gone because they do not have any cash to keep the lights on or to pay supplies and their own workers,” said Njoroge.

However, the governor did not give any indication when the scheme would be activated, saying Treasury was the lead organ on the matter, but offered that it “will probably be a significant element in the Budget.”

“We cannot do this as business as usual. Unfortunately even when things are urgent we end up taking a sort of the scenic route in terms of implementation.

From our perspective this is the one thing we are insisting on, that the time frame has to be as short as possible,” he said.

Kenya has 1,618 confirmed coronavirus cases and 58 deaths and has tried to flatten the curve by suspending commercial flights, imposing a dusk-to-dawn curfew and banning public gatherings.

Movement in and out of five regions, including Nairobi, had the biggest knock-on effect on SMEs.

Online platforms

Majority of small enterprises are having a hard time sustaining operations during this tumultuous time.

While more firms take to online platforms to boost sales, some lesser-known establishments do not have this option with many forced to close shop.

Most that have been providing breakfast snacks and lunch in offices, running salons or making clothes have had to close shop.

Other fairly stable ones in the manufacturing sector have been forced by circumstances to start producing personal protective equipment to survive.

A number of these SMEs, which make total annual revenues of Sh5 million and below, are currently struggling to meet their tax obligation and pay for utilities amidst the heavy losses.

Data by the Kenya National Bureau of Statistics (KNBS) shows that SME enterprises constitute about 98 per cent of all the businesses in the country, employing about 14.9 million Kenyans, with SMEs accounting for more than 30 per cent of the country’s GDP.

In his address yesterday, Njoroge said he expects the economy to start a gradual recovery process in the third quarter, but cautioned that the hospitality and transportation sectors would take longer, as it was unlikely tourism would recover by next year.

CBK retained its economic growth projection at 2.3 per cent for 2020 saying the target is not ambitious but rather a best estimate, taking into account all uncertainties.

It also retained its overall benchmark rate at seven per cent indicating continued policy translation.