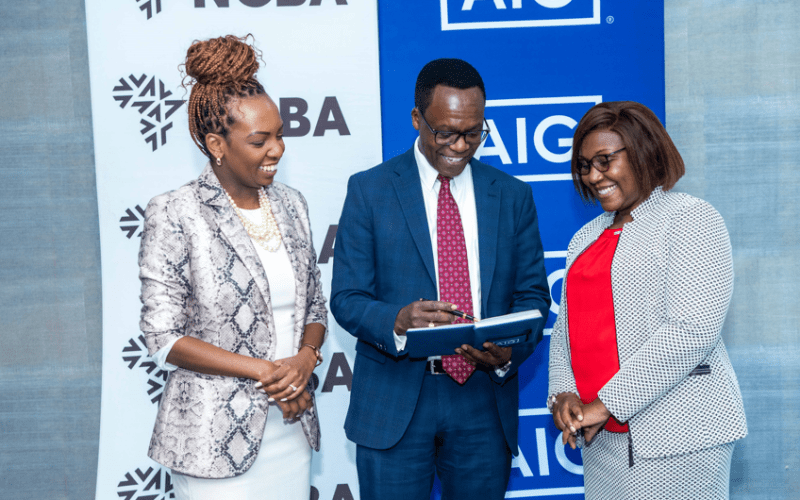

NCBA completes acquisition of 100% stake in AIG Insurance

NCBA Group (NCBA) has completed the acquisition of a 100 per cent stake in AIG Kenya Insurance Company Limited (AIG Kenya).

For over 18 years, the lender has held a minority shareholding in AIG Kenya, which offers its services to corporates, SMEs, and individuals.

“We are excited to welcome AIG Kenya to the NCBA family, and this acquisition will enable our customers to access all their financial products under one roof conveniently. With insurance increasingly becoming a basic financial need for our customers, an ecosystem of NCBA’s physical and digital distribution platforms and AIG Kenya’s insurance capabilities will unlock opportunities to catalyze deeper insurance market penetration in Kenya and the East Africa region,” NCBA’s Group Managing Director John Gachora said.

Currently, the insurance industry in Kenya is valued at Ksh309 billion, which continues to grow at a compound annual growth rate of 10 per cent.

“The acquisition marks a significant milestone in our company’s evolution. NCBA’s resources, expertise, and expansive network will enhance our capabilities, allowing us to offer a broader range of products and services, improve our operational efficiencies, and provide greater value to our customers and partners,” Stella Njunge, CEO of AIG Kenya.

NCBA's plan to acquire AIG

The lender's plan to acquire AIG Insurance was made public in September 2023.

"If concluded, the acquisition of the over 50-year-old insurance business, which has a heralded market reputation for offering a sophisticated general insurance proposition to corporates, SMEs and individuals would be a landmark transaction," the lender said in September 2023.

The banking group, formed out of a merger between NIC Group and CBA Group in 2019, is now the third largest banking Group in East Africa serving over 63 million customers and with a network of 107 branches.