Mudavadi decries lack of access to credit by small-scale farmers

Majority of smallholder farmers in Kenya spend up to 40 per cent of their income on inputs, without a guarantee of fair prices at harvest, a situation the government blames on lack of receptive agriculture financing products.

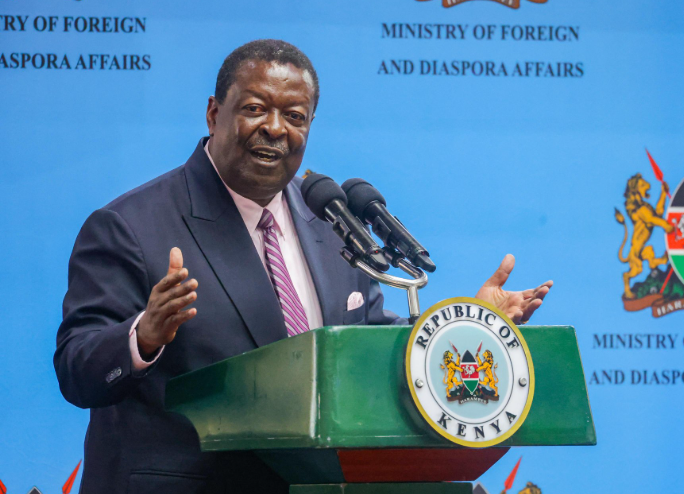

Prime Cabinet Secretary and Cabinet Secretary for Foreign and Diaspora Affairs Musalia Mudavadi said lack of access to credit by small-scale farmers is a big blow to boost food productivity and taming other economic miseries.

He, for example, claimed that many maize basket counties of Uasin Gishu, Nandi, Trans Nzoia and Bungoma spend close to half their income to purchase certified seed, fertiliser and mechanisation services.

Mudavadi made the remarks yesterday during the Financing Agri-food Systems Sustainably -Summit (FINAS) 2025 at Kenyatta International Convention Centre (KICC).

Informal lenders

“Access to credit is even more challenging—only a small fraction of smallholders in Kenya have access to formal agricultural financing, with the majority relying on informal lenders or self-financing through savings, which limits their ability to scale or improve productivity,” he said,

He noted that these challenges are further compounded by the growing threat of climate change. “Farmers now face unpredictable rainfall, prolonged droughts, and frequent pest outbreaks such as the fall armyworm, which have significantly affected staple crop yields,” stated Mudavadi.

Smallholder producers

He observed that much of Kenya’s agricultural sector—like much of Africa’s—is fundamentally built on the backbone of smallholder producers.

“These small-scale farmers, who cultivate plots often less than two hectares, are responsible for over 75 per cent of the country’s agricultural output and the majority of our domestic food supply. Yet, despite their crucial role, they operate within highly fragmented and underdeveloped value chains,” he added.

Heifer International Kenya Country Director Clarice Bugo-Kionge noted that despite agriculture employing 60 per cent of Africa’s population and driving significant GDP, agritech still receives less than one per cent of global venture capital investment.

“This is not just unfair; it’s economically irrational and a profound missed opportunity for our continent,” he said during the summit.

Mudavadi noted that financing systems in Africa are still not fully aligned with the region’s untapped potential.