MPs pause VAT Bill 2025 to allow further probe on exemptions

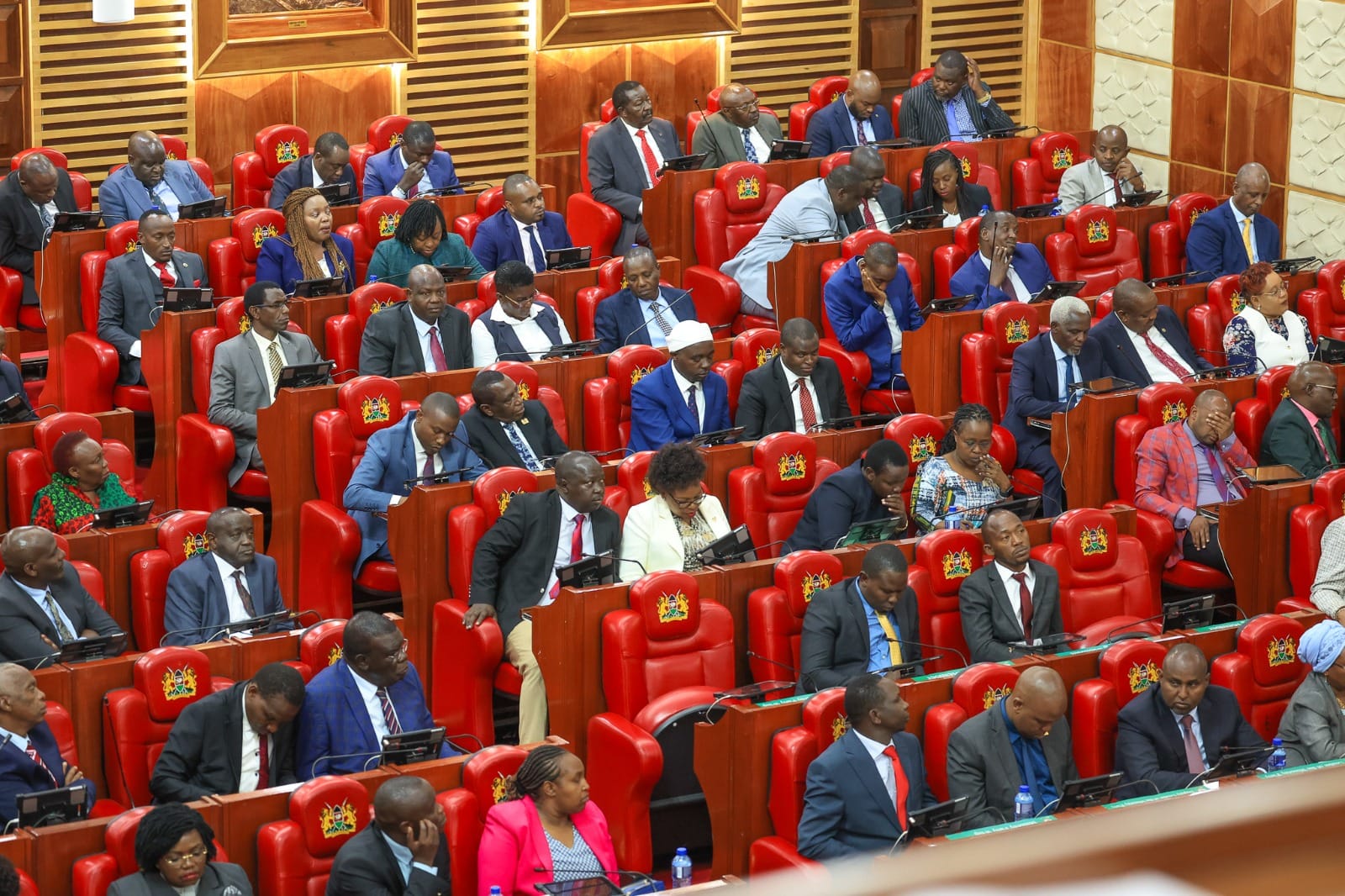

The National Assembly has paused the VAT (Amendment) Bill 2025, a government-backed proposal meant to correct a printing mistake in a previous law.

The error led to 14 manufacturing companies receiving VAT exemptions worth Sh15 billion. The companies have investments in Kenya valued at about Sh93.5 billion.

Speaker Moses Wetang’ula agreed to a request by Majority Leader Kimani Ichung’wah to stop the Bill for now.

Ichung’wah said more time is needed to investigate whether these VAT exemptions actually match the investments the companies have made in Kenya.

“The committee needs to establish the exact quantum of what is sought to be exempted and the beneficiaries of those exemptions and also to ascertain that they are indeed actual investments that have been made in the country,” Ichung’wah told the House.

Ichung’wah explained to Parliament that the Finance and National Planning Committee, chaired by Molo MP Kuria Kimani, needs to understand what businesses these companies are involved in and whether the tax exemptions are justified.

The issue comes at a time when the government is struggling to raise enough money to fund its operations.

Committee chair Kuria Kimani noted that they are not trying to delay any Bill, but they want to be thorough.

He said the Bill was brought to correct a printing error in the Tax Laws (Amendment) Act that was passed earlier.

He acknowledged that tax changes can support manufacturing, but warned that exemptions should be carefully managed to avoid abuse. The Tax Laws (Amendment) Act became active on December 27, 2024.

It stated that only investments of at least Sh2 billion would qualify for VAT exemptions.

However, MPs are concerned that the law was backdated to take effect from January 2024, which goes against standard legislative practices.

Suna East MP Junet Mohamed criticised the Bill, questioning why Parliament would approve such massive exemptions while funds for essential programmes like the National Government-Constituency Development Fund are still lacking.

He said Parliament must confirm whether these investments truly happened, where they are located, and what benefit they bring to Kenyans.

Documents from National Treasury Principal Secretary Chris Kiptoo revealed the 14 companies that received the tax breaks before the law was officially passed.

He said the list was shared in the interest of transparency.

Among the companies is Devki Steel Mills, which has a large steel project in Samburu and Kwale counties. The company received VAT exemptions of Sh1.33 billion since March 2023 for investments worth Sh8.32 billion.

Its Iron Ore Processing Plant in Voi also got Sh1.1 billion in exemptions for a Sh6.9 billion project.

Another company, National Cement Company Limited, received Sh516.5 million for its waste heat recovery plant in Kilifi and Sh921.35 million for its cement grinding plant in Eldoret.