Mobile money boom as Kenyans move Sh8.7tr

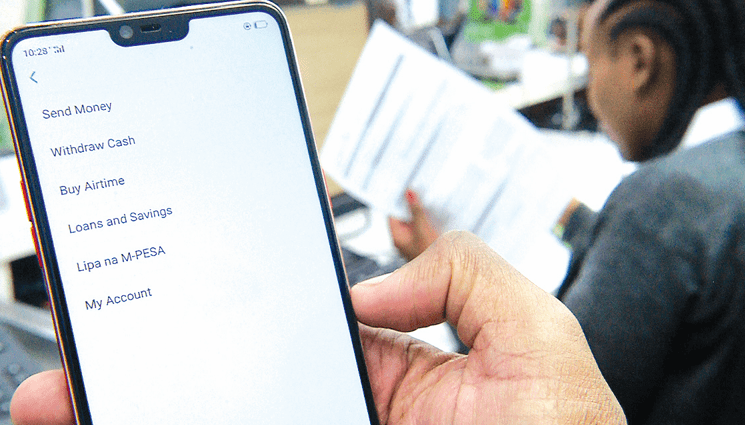

In a year when the cost of living soared and wallets felt lighter, Kenyans still moved a jaw-dropping Sh8.7 trillion through mobile money—an amount that rivals nearly half of the country’s gross domestic product (GDP).

It’s a staggering figure that speaks volumes about Kenya’s deep-rooted mobile money culture, proving once again that when it comes to financial transactions, the phone is king in Kenya. According to fresh data from the Central Bank of Kenya (CBK), mobile money transactions grew by 9.4 per cent in 2024, up from Sh7.95 trillion the previous year.

In February of 2024, Sh790.8 billion was transferred across 213.34 million agents marking the highest transfers during the period while September recorded the lowest transactions totaling Sh670 billion from the 196.49 agents.

This, despite widespread economic struggles, rising taxes, and a cash-strapped population navigating a tough financial landscape. The sheer scale of these transactions underscores how mobile money has evolved beyond simple peer-to-peer transfers to become the lifeblood of the economy.

From paying bills and school fees to handling business payments and government services, Kenyans are increasingly dependent on mobile wallets. The numbers also paint a telling picture of how financial behavior is shifting—where traditional banking lags, mobile money surges. To put it into perspective, Kenya’s GDP was estimated at around Sh17.8 trillion in 2023. That means mobile money transactions accounted for nearly 50 per cent of the entire economy’s output.

During that period, the number of people employed as mobile money agents increased to 381,116, from 322,000 at the end of December 2023 as subscriptions closed the year at 82 million, according to the apex bank.

As highlighted in a different report by the regulator, the transactions could have been influenced by the tough economic environment as the majority of Kenyans accessed the financial inclusion fund, popularly known as the “hustler Fund” among other short-term credits from digital lenders across the country.

Central Bank of Kenya, in November last year reported that the percentage of Kenyans who relied on credit for basic household items increased to 64 per cent from 60.8 per cent in the previous year.

“The increase in credit access was attributed to the rise of app-based digital loans and mobile money credit, which made it easy for the majority of Kenyans to access financial services easily,” CBK said in the report. As of March, last year, the number of digital lending companies in the country that had been approved by the CBK stood at 52, mirroring the high demand for the services.

Between 2022 and 2024, Kenyans borrowed a total of Sh60 billion through Hustler fund according to president William Ruto, who had mentioned that it enabled small scale businesses to attend to their short-term financial shortfalls.

The improved transaction rate may have also been boosted by cross-platform money transfer services among telcos in the country. Airtel’s cross-platform money transfer service emerged as a significant contributor towards the growth coming in second after Safaricom’s M-Pesa, which is currently commanding 92.3 per cent of the total market share, according to data by the Communication Authority of Kenya (CA).

Bolstered competition

The move, which allows users to send and receive funds across different networks, has bolstered competition and enhanced accessibility to financial services.

“This development comes in response to the Central Bank of Kenya (CBK) and industry players’ collaborative efforts to ensure seamless mobile money interoperability as outlined in the CBK National Payment Strategy 2022-2025.” Airtel said in a statement. Moreover, Airtel Money’s improved user experience, including the removal of restrictive withdrawal codes, has made cross-platform transactions more attractive, providing customers with flexibility that M-Pesa had monopolised for years.

The increased competition has also pushed service providers to innovate and review their pricing strategies, meaning a win for consumers, who can now expect lower transaction costs, better service offerings, and expanded financial products such as loans, savings, and insurance.