Manufacturers explain how new taxes have made Kenya to be flooded with EAC products

The Kenya Association of Manufacturers (KAM) has linked the spike of products from other East African countries in the Kenyan market to new tax measures.

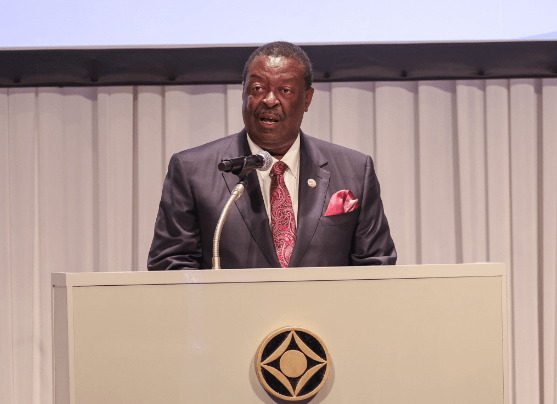

Speaking on Wednesday, May 22, 2024, KAM Chief Executive Officer (CEO) Anthony Mwangi indicated that the new levies and taxes have majorly burdened Kenyan producers forcing them to slow down their operations.

Instead of mass production, Mwangi noted that most manufacturers have resolved to import products from other EAC markets which are affordable.

Mwangi indicated that Kenya used to be among the largest exporters of paper but due to the new taxes introduced in 2023, the country has become an importer of the product.

“Kenya operates within the EAC Common market, COMESA, and now AfCFTA. Any fees, levies, and duties imposed by the Government of Kenya are domestic taxes that affect only Kenyan products and companies. Consequently, Kenyan companies and products become uncompetitive, leading to our market being flooded with products from other EAC and COMESA countries,” Mwangi stated.

“For instance, Kenya used to be the largest exporter of paper and steel products to the EAC, but due to the Finance Act 2023, we have become an importer of these products.”

According to Mwangi, the situation is set to be worsened if the Finance Bill 2024 is passed without amendments. Mwangi argued that the Export Investment Promotion Levy (EIPL) on the paper, steel and cement sectors will have a major negative effect on the construction industry.

In his argument, Mwangi detailed that the cost of construction has increased by 40 per cent due to the new tax policies.

“KAM has analyzed, in detail, the impact of the Export Investment Promotion Levy (EIPL) on the paper, steel and cement sectors and has noted unparalleled negative unintended consequences in those sectors that are crucial to the economy.

“The cost of construction has since gone up by at least 40 per cent due to this unwarranted policy action. Regrettably, we have noted an enhanced list of products under EIPL in the Finance Bill 2024 such as raw materials for manufacturing of paper packaging materials, critical for packaging food products and household items,” he remarked.

Before 2015, we imported diapers and sanitary wear, but since then, we have developed local manufacturing capacity. However, with the introduction of the eco levy, we might see an increase in imports again, as it will become cheaper for consumers to purchase imported products. -… pic.twitter.com/GkXaLYWPOO

— KAM (@KAM_Kenya) May 22, 2024

More taxes

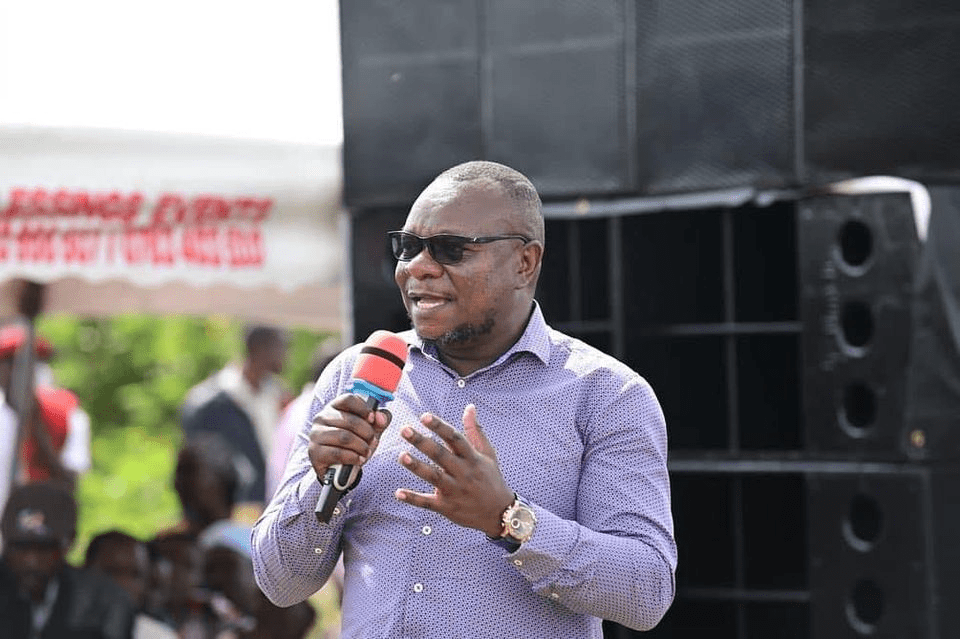

Mwangi warned that the price of edible cooking oil would rise by 80 per cent due to the proposed 25 per cent excise duty.

Other basic items like mugs and basins would also increase due to the eco levy contained in the Finance Act 2024.

“The introduction of a 10 per cent excise duty on plastic products will significantly increase the cost of items like basins and mugs used by Mwananchi, with the price of a basin rising from Ksh110 to approximately Ksh200 due to this proposal combined with other levies, such as the eco levy,” Mwangi noted.

However, the Kenya Kwanza administration has maintained that public participation will inform the next decision on the introduction of new taxes as contained in the Finance Act 2024.

For these and more credible stories, join our revamped Telegram and WhatsApp channels.

Telegram: https://t.me/peopledailydigital

WhatsApp: https://whatsapp.com/channel/0029Va698juDOQIToHyu1p2z