Lender waives bank to M-Pesa charges

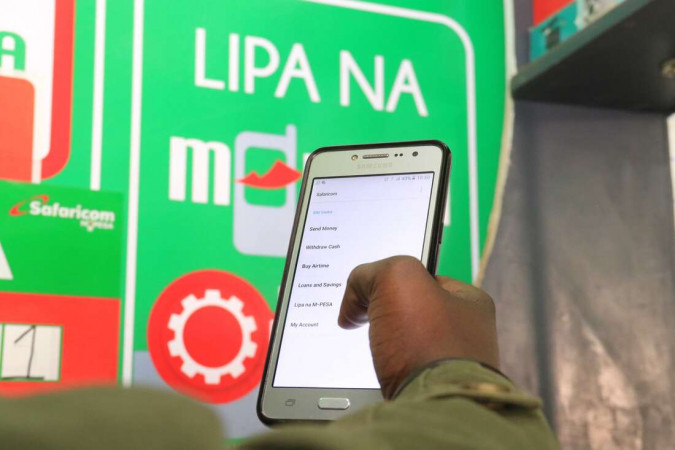

The I&M Bank has waived transaction fees from bank to M-Pesa to deepen its digital banking and offer reprieve to customers hit by high transaction charges.

This move makes it the first lender to officially offer zero fees for bank to M-Pesa since reintroduction of bank to mobile money wallet charges by the Central Bank of Kenya (CBK) in January 2023.

The waiver which will apply on it digital banking platform dubbed ‘I&M On The Go (OTG)’ to mobile money wallets will also include T-Kash transactions for Telkom users in the deal soon.

Michael Mwangi, I&M Bank’s General Manager for Digital Business says the move was in response to customer feedback and the bank’s approach to service delivery.

“As part of our approach to service delivery, recent customer feedback showed that as much as our transaction rates are favourable, there was an opportunity to review our policies on bank to mobile money wallet charges for the digitally active customer,” said Mwangi.

Mwangi believes that the waiver of fees will offer new and existing customers relief during tough economic times and encourage more customers to transact on mobile.

The Covid-19 pandemic emergency measures saw the transaction charges between mobile money wallets and bank accounts being waived in March 2020, expanding the payment ecosystem.

“I&M Bank Kenya’s move to offer zero fees on Bank to Mobile Money Wallet transfers meets consumer needs and provides an affordable solution for its customers,” the bank said.

The bank intends to enhance its digital banking solutions to meet the needs of its customers and grow numbers through digital transactions.