Kenya lagging behind in race towards EAC monetary union

Kenya failed to meet two key East African Monetary Union (EAMU) convergence yardsticks during the financial year 2020/21, Central Bank has said.

According to the banking sector regulator, the country did not meet the criteria on fiscal deficit and gross national debt during the period under review.

It attributed the failure to increased public spending to mitigate the diverse impact of Coronavirus (Covid-19) on businesses and households, reduced tax revenue due to the pandemic, and continued public investment in physical infrastructure.

“However, Kenya met the EAMU convergence criteria on inflation and foreign exchange reserves,” the banking sector regulator said in its annual report for 2020/21.

Available data shows that the country’s public debt as a percentage of gross domestic product (GDP) hit 68 per cent in June this year while member countries are expected to have less than 65 per cent debt to GDP ratio.

Kenya also collected Sh1.4 trillion in taxes in 2019 which is less than the 20 per cent tax to GDP ratio requirement by the East African Community (EAC), Comesa and the African Association of Central Banks.

In preparation for the EAMU, the EAC Partner States have agreed to attain and maintain for at least three consecutive years four macroeconomic convergence criteria.

Thse are, a ceiling on overall inflation of 8 per cent; a ceiling on fiscal deficit, including grants, of 3 per cent of GDP; a ceiling on gross public debt of 50 per cent of GDP in net present value terms; and a floor of foreign exchange reserves cover of 4.5 months of imports.

The over-arching objective of the Common Market for Eastern and Southern Africa monetary co-operation programme is the establishment of a Monetary Union by the year 2025.

Government borrowing

Former head of Sterling Capital John Kirimi, these conditions are important in the sense that they help countries to be disciplined.

“However, the workings of the Central Bank and Treasury have to be harmonised namely; monetary and fiscal policy have to be in sync,” he added.

Kirimi said politicians have to be reined in to control government borrowing otherwise the central bank alone cannot meet those objectives.

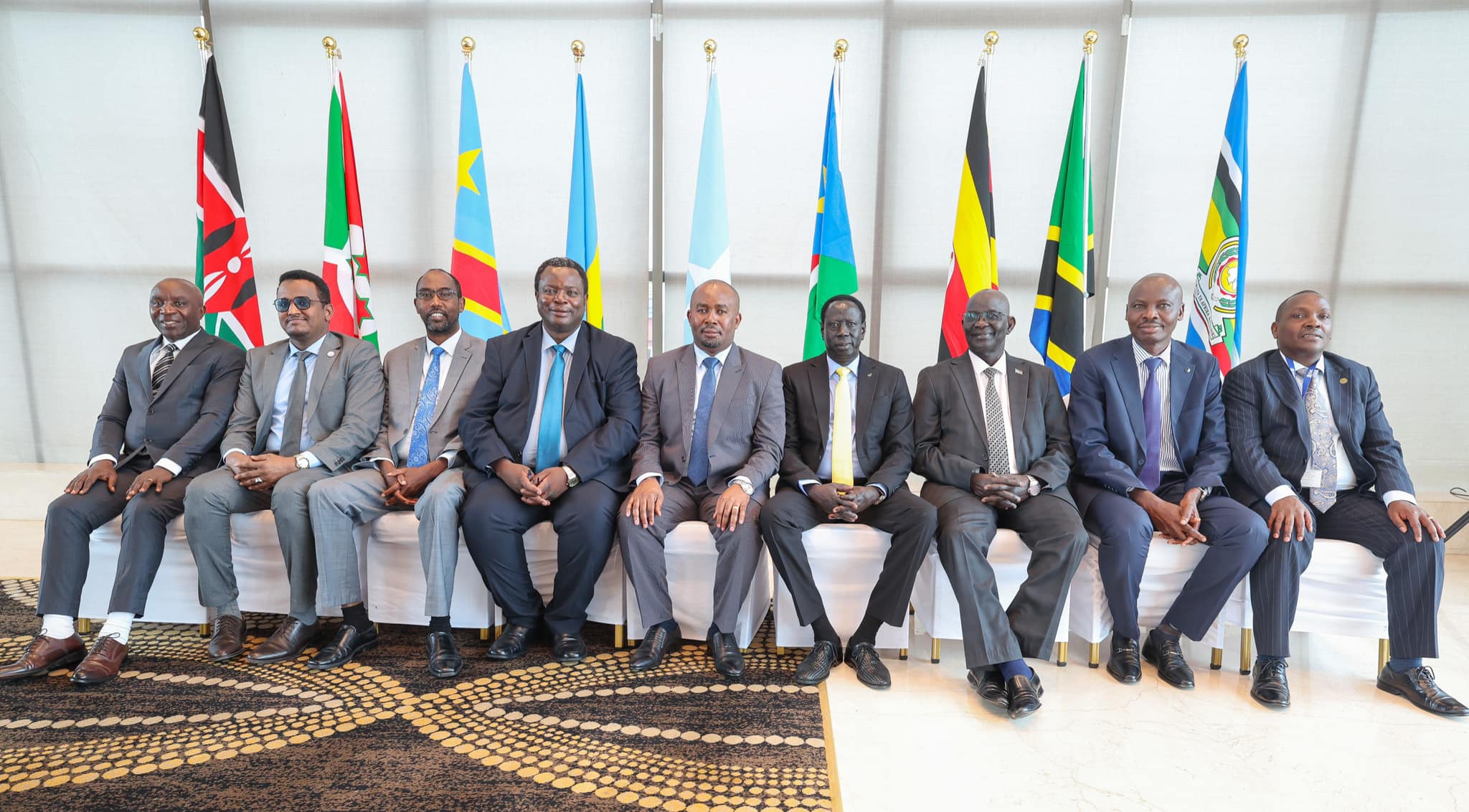

The CBK this year participated in regional integration initiatives under the EAC, Comesa and the Association of African Central Banks (AACB).

The initiatives involved harmonising economic and financial policies among partner states, strengthening regional financial sector supervision, and integrating regional financial systems.

“The aim of these integration efforts is increased intra-regional trade, higher economic growth rates of partner countries and regional peace,” CBK said in the annual report.

Kirimi said that race towards a monetary union should ensure that African states can trade without tariffs but this will depend on how well that integration works.