Kenya and China likely to seal debt deal, experts say

Analysts expect Kenya to clinch a debt suspension deal with China for the sake of the Asian nation’s strategic purposes but the hurdle is that the entire sub-Saharan Africa (SSA) appears to be in near default.

Treasury officials are optimistic on striking a debt suspension deal with China after the Asian nation said there is no reason to believe it will not be done.

Chinese Embassy Spokesman Huang Xueqing said the two countries are already in smooth communication and that they have already offered debt suspension to 12 countries in Africa.

This will be a welcome reprieve to Kenya, which just secured a six-month breather from the Paris club.

“We stand ready to strengthen coordination with Kenya and assist in its efforts to address debt challenges,” she said.

China is one of Kenya’s biggest external creditors, having lent billions of dollars for the construction of rail lines and other infrastructure projects in the past decade.

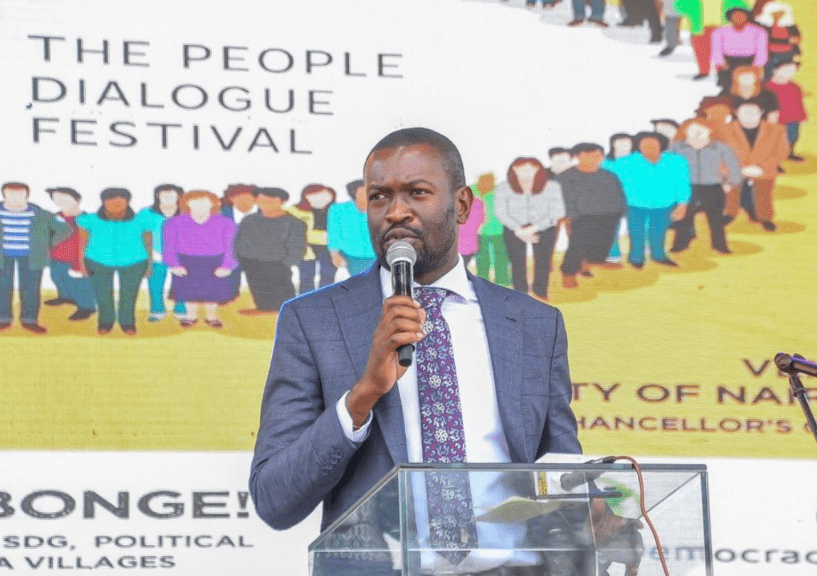

“There is normally competition between the Paris Club and China where each wants to woo African countries, so China is likely to agree to a deal,” said University of Nairobi lecturer Gerishon Ikiara.

Ikiara said that China debt suspension will go a long way in easing cashflow pressure on Treasury it waits for economic growth to gather pace.

Independent analyst AlyKhan Satchu said the challenge for China is that the entire SSA portfolio looks ostensibly in default.

“The Guillotine is quite close now. I think it’s a Catch 22 for China because they will be seen as very recalcitrant if they don’t provide relief.

So yes I expect the can to be kicked down the road but zero forgiveness,” he said.

Satchu added that the problem remains the debt is unsustainable and the SGR project is unlikely to provide an Return on Investment for the foreseeable future.

China would seek to score against the World Bank which recently forced Kenya to roll back taxes and other demands.

Kenya hopes that the recovery of tourism and jobs will help stabilise its finances.

Africa’s plight

“For China it is both economic and strategic, it does not want to be seen as being insensitive to Africa’s plight,” he said.

African countries prefer to borrow from China as its loans have less conditions compared to the countries in the Paris Club.

The five-year debt holiday given by the China Exim Bank for the $1.4 billion loan used to build the Nairobi to Naivasha Standard Gauge Railway is also coming to an end on Thursday which could further put a strain on Treasury.

Kenya will therefore likely pile pressure on China for a last minute deal to save its cashflow.

The Treasury already said that its cash disbursements to counties is behind by two months.

The economy is expected to grow by 6.9 per cent, according to World Bank with rating agency Moody’s projecting a five per cent growth this year which could help generate sufficient cash flow to continue debt payment.

Moody’s said that Kenya’s debt is expected to hit 70 per cent of gross domestic product (GDP) by June 2021.