Invesco put in statutory management

Invesco Assurance Company Limited (INVESCO) has been placed under statutory management by the Insurance Regulatory Authority (IRA) effective August 14, 2024 to cushion policy-holders.

The regulator says that the action will also ensure stability within the insurance sector as the company faces significant financial challenges.

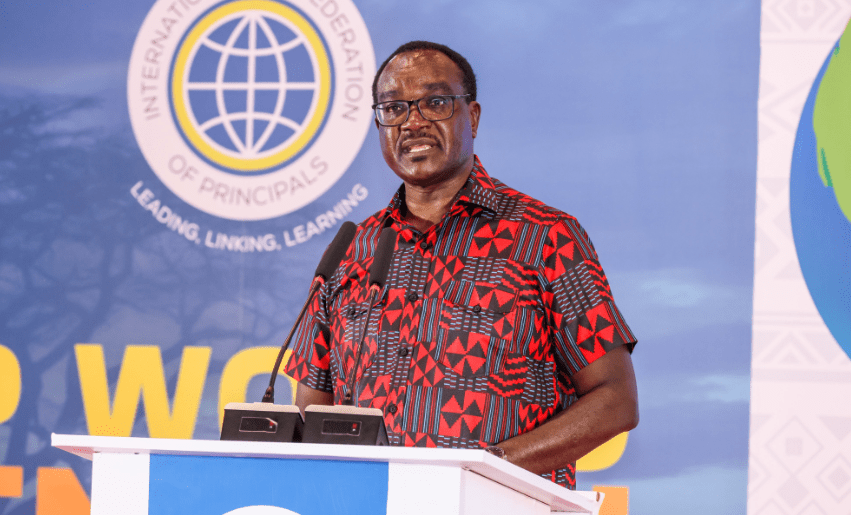

IRA Commissioner General Godfrey Kiptum announced the appointment of the Policyholders Compensation Fund (PCF) as the statutory manager for Invesco.

Kiptum has advised current policyholders to seek alternative coverage from other licensed insurers immediately to avoid unnecessary exposure. The PCF would handle the compensation of affected claimants as stipulated under the Insurance Act, Cap 487 Laws of Kenya.

“The authority has appointed the Policyholders Compensation Fund (PCF) as the Statutory Manager for Invesco Assurance Company Limited (under statutory management). The insurer’s existing policyholders are advised to immediately seek alternative covers from other licensed insurers to ensure there is no unnecessary exposure. The Policyholders Compensation Fund will compensate the affected claimants as provided for under the Insurance Act, Cap 487 Laws of Kenya,” Kiptum stated in a formal announcement.

The PCF’s responsibilities include safeguarding the rights of policyholders, managing ongoing claims, and facilitating compensation for those impacted during this transition. Invesco Assurance, now under statutory management, is no longer authorized to enter into any new insurance contracts from August 14, 2024, onward.

Invesco has been grappling with severe financial difficulties, resulting in a liquidity crisis that has significantly impaired its ability to meet its obligations. The company has defaulted on claims totalling approximately $400,000 (Sh53.3 million), primarily related to road traffic accident victims.

Furthermore, the insurer is dealing with an overwhelming backlog of 3,692,353 claims, with only 48,207 claims settled in the last quarter of 2022. This has led to a payment ratio of just 1.2 per cent, raising serious concerns about the company’s financial stability.

The last time Invesco’s financial filings were in order was in 2018 when it collected Sh1.5 billion in premiums and held a market share of 1.2 per cent of general insurance premiums. Since then, the company’s financial health has deteriorated significantly.

Invesco Assurance specializes in motor vehicle insurance, including coverage for public service vehicles (PSVs), commercial vehicles, and private vehicles. The company also offers non-motor insurance products, such as fire and allied perils, burglary, public liability, and personal accident coverage.