How Kenyans are getting through cost of living crisis

As cost of living soars, Kenyans are getting savvy with their spending, going for brands that not only solve their daily needs but also offer headroom in payment, a new survey shows.

The study released by Super brand indicates that tough economic times have led consumers into thrifty spending as they seek to counteract the effects of inflation.

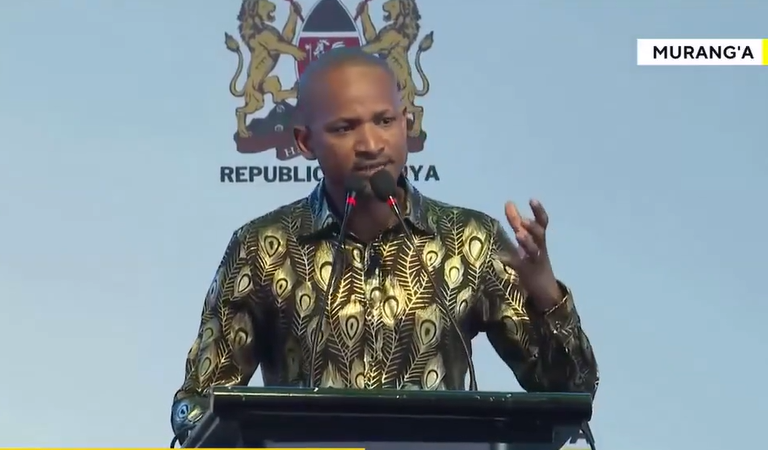

According to David Ogara the associate account director at Kantar, which carried out the Kantar Africa Life Report in partnership with Super brand East Africa, with challenging times, it has been interesting to understand how consumer perception and brand value offerings have evolved.

“Inflation has divided brands and products between ‘must-haves’ and ‘nice-to-haves’ creating a clear distinction when purchase decisions are being made,” he says. Inflation’s nudge pushed the annual rate to 5.1 per cent this May, a notch up from April’s 5 per cent driven by food and drink prices, which jumped 6.2 per cent, while housing and utilities rose 4.4 per cent partly due to post-flood electricity price surges.

Less disposable incomes

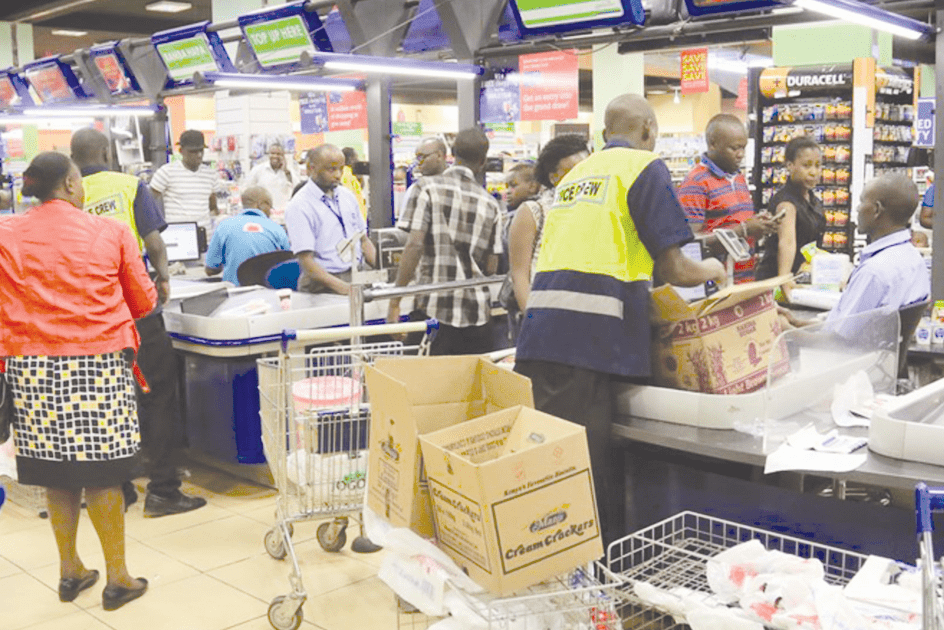

With less disposable incomes, the urbanites of Nairobi, Mombasa, and Kisumu, where the survey was conducted are tightening their spending habits by buying less, sticking to essentials, hunting for bargain deals, and leaning on platforms that promise more value for their hard-earned cash.

“In response to these inflationary pressures, consumers are becoming more mindful of their spending, taking deliberate steps to purchase less, buy only essential items, seek out less expensive options and utilise more affordable buying platforms,” the study says.

It also indicates a financial behavioural shift, with more Kenyans turning to micro-lending and informal banking for quicker cash access. Mobile loans and “buy now pay later” options are gaining fans, signalling a tilt towards more flexible money matters.

“There is a shift in their engagement with financial entities and services, with a greater dependence on micro-lending and pivot towards informal banking systems for more convenient financial access,” the survey notes.

In the poll, M-Pesa kept its crown as Kenya’s top Superbrand, with parent company Safaricom hot on its heels. M-Pesa’s lifeline to small and medium enterprises (SME) is a big win, especially with consumers hunting for gentle lending terms without the steep penalties.

M-Kopa’s climb from rank 36 to rank 6 is no small feat as it shows its alignment with the careful spending habits of the budget-conscious, offering key products on easy payment plans.

M-Kopa is an African-based platform, specializing in connected asset financing. It caters to the unbanked population in Africa, offering them vital products such as solar lighting, television, fridges, smartphones and financial services.

As for Safaricom, it is not just about calls and texts. Its data plans are fuelling e-commerce, a growing slice of Kenya’s income pie. This digital push has helped Safaricom snag the second spot in the Superbrand stakes.

Changing consumer needs

“Once again, the study has emerged as a barometer for changing consumer needs and preferences. Brands must strive to provide value to climb the ranks as consumers prioritise needs over wants,” Jawad Jaffer, project manager at Super brands East Africa said.

Other brands that made it to the top 10 include Bamburi Cement, a reflection of Kenya’s growing population and urbanisation, as well as Kenpoly, which makes disposable cups common in informal social meet-ups for quick consumption of alcohol and other beverages.