Government to regulate information shared by digital lenders about borrowers

The Central Bank of Kenya (CBK) has rolled out a new guideline on the listing of loan defaulters with the Credit Refference Bureau (CRB) by digital lenders.

Through the Credit Information Sharing Association of Kenya (CIS), CBK has come up with a new code of conduct that will see unregulated digital lenders return to the credit information sharing mechanism.

The code which has the backing of CBK is expected to provide a framework for best practice by the non-regulated players.

Under changes to the Central Bank Act which is under consideration of Parliarment, digital lenders are set to be ushered back to credit information sharing which will allow parties to access and list borrowers with CRB.

The code which was approved in May this year is founded on data quality, customer protection and customer-centricity.

Parties are expected to sign up to the code by December 31 this year.

Principles of the code include customer consent which covers clear and specific consent by customers to parties in relation to the sharing of credit information.

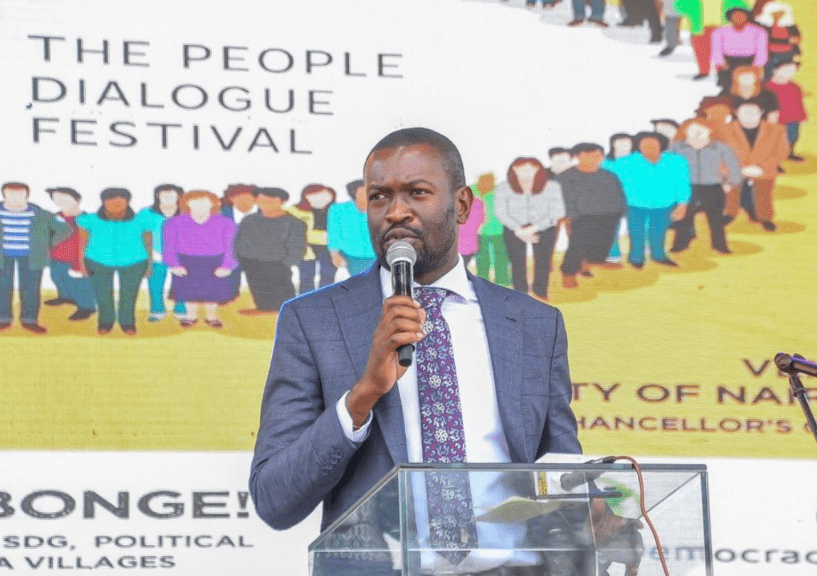

While the code is not only limited to compliance, CIS Kenya CEO Jared Getenga expects the code to resolve some of the weaknesses seen in credit information sharing.

“People have complained of how data in their phone-books is being misused, others have complained of listing threats from lenders. This is harassment. CRBs are not debt collection agencies,” Getanga said.

“It’s also not purely about just compliance but also supporting the parties to be able to submit their data accurately, on time and comprehensively.”

While prior code of conducts across sectors and self regulation have failed to cure ills, Getenga expects the backing of CBK to be integral to enforcement of the code’s provisions.

“We have been empowered by the CBK to submit quarterly reports. In the case of non-compliance, the CBK can impose financial penalties or even withdraw the participation of a party in the CIS mechanism,” he said.

“This is a critical step towards restoring order in the credit industry. The CBK is likely to require parties withdrawn from the CIS mechanism to return through the code of conduct.”

While blocking digital lenders from accessing CRBs, the CBK accused the parties of abusing the mechanism after numerous complains by Kenyans.

The new code of conduct is anchored on the Banking (Credit Reference Bureau) Regulations of 2020.

Author Profile

Collins Osanya

Collins Osanya is a multimedia journalist, communications specialist, and creative writer.

View all posts by Collins Osanya