Firms struggle with debt repayments over dollar scarcity

Companies with large foreign currency debt are struggling with repayments as exchange rates continues to deteriorate amidst shortage of US dollars in the local market.

Centum Investments, Kenya Power and Kenya Airways and Airtel are some of the companies that are losing millions of shillings due to foreign currency losses.

The local currency has weakened from Sh106 to one US dollar to Sh119 units to one US dollar, meaning that it now costs Sh13 more to pay one dollar worth of debt.

Centum, which borrowed $50 million from South Africa’s Rand Merchant bank now says it has $10 million dollars of USD-denominated debt under Centum and the rest under Two Rivers Lifestyle Development and Centum Re.

The company has swapped some of their marketable securities portfolio investments to dollar assets to offset foreign currency translation losses.

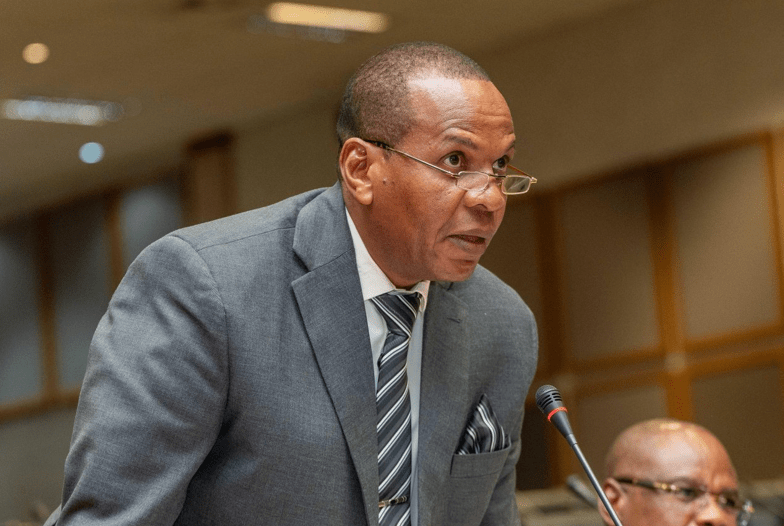

“Once we complete the exit from Sidian Bank, we want to use some of the money to retire the dollar-denominated portion of the loan at Centum level,” said Centum CEO James Mworia. Centum sold its 83 per cent in Sidian bank to Nigeria’s Access Bank at Sh4.3 billion. Mworia said that for Centum Real Estate, the bulk of the debt repayment is being focused on reducing the dollar-denominated debt to cut foreign currency exposure.

“I think the issue now is only largely Two Rivers Lifestyle Development and that will be cured by what we are doing in terms of swaps and funds from Sidian exit,” said Mworia.

Translation losses

Kenya Airways on the other side has lost over Sh500 million in foreign currency translation losses on borrowings as of the last financial year and the company is expected to suffer more seriously this year due to sharp currency fall.

“A 10 per cent appreciation or depreciation of the Kenyan shilling against the USD, Euro and GBP would increase or decrease the reported profit or loss by Sh13 billion,” said KQ in its latest annual report.

The forex risk has been exacerbated by a shortage of dollars in the domestic market with importers saying they have to go to multiple banks in order to collect sufficient dollars to meet their obligations.. – John Otini