Equity hits Sh1tr asset base mark

Equity Bank has broken through the Sh1 trillion asset base mark to become the largest lender in East and Central Africa, lifting its visibility to compete in bigger project finance.

The lender says the milestone was achieved after the migration of the balance sheet of the Commercial Bank of Congo, which it acquired recently, on its core banking platform.

This war chest will equip Equity to compete favorably with other financial institutions in South Africa, West Africa and North Africa whose capitalisation has in the past overshadowed East African banks.

It is also the most capitalised bank in the region at Sh142 billion which puts it in a position to give a loan of Sh35 billion to one project at a go, similar to that required to construct Thika Road.

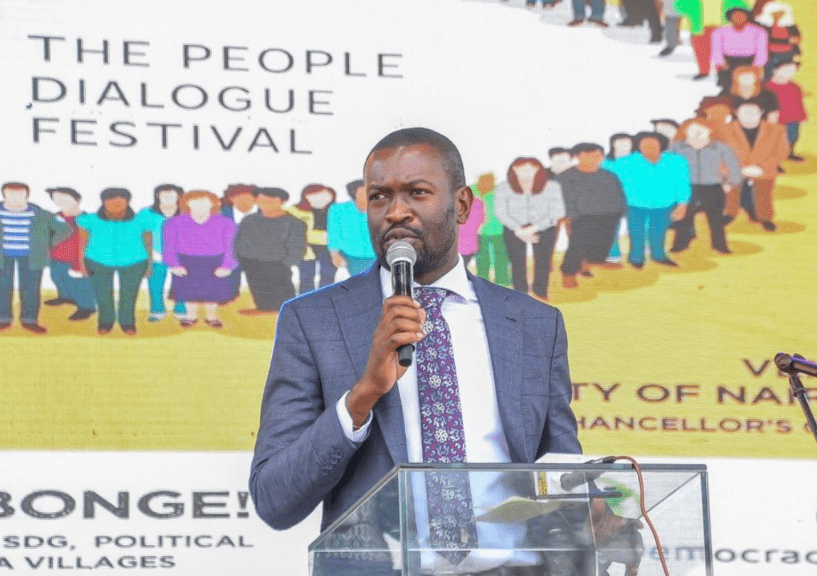

Speaking from Kinshasa Congo where he was witnessing the migration of BCDC to Equity’s core banking platform, Equity Bank CEO James Mwangi said, “We are delighted to witness this milestone that has shattered the psychological barrier of a trillion-shilling balance sheet”.

Equity banking subsidiaries will now be in a position to leverage the Group’s strength to extend large corporate loans across all the countries where Equity operates.

Mwangi lauded Commercial Bank of Congo or Banque Commercial Du Congo (BCDC) as it is known in French for its 112-years experience in corporate banking adding that Equity brings the agility of a dynamic and disruptive business model.

With branches in Uganda, Rwanda, two acquisitions in DRC and Ethiopia, Equity sees itself as a goto bank for major developments projects across the East and Central Africa region.

Having liveraged on retail segment to grow its reach, the bank is now targeting project and corporate finance as a key focus areas.

“We are excited at the possibilities that Equity Group brings to our customers.

By becoming part of a large international financial services Group, our customers will enjoy a wider choice of products and they will immediately be able to access modern technologically driven banking,” said Yves Cuypers, BCDC’s Managing Director.