Empty coffers may push country into a debt trap

Despite optimism, Kenya is running on empty coffers and year 2021 may be tough for the economy as potential for borrowing hits it’s ceiling, analysts have said.

This after it emerged that Treasury is reaching out to Parliament once again to raise the nation’s debt ceiling from the current Sh9 trillion to a whopping Sh12 trillion.

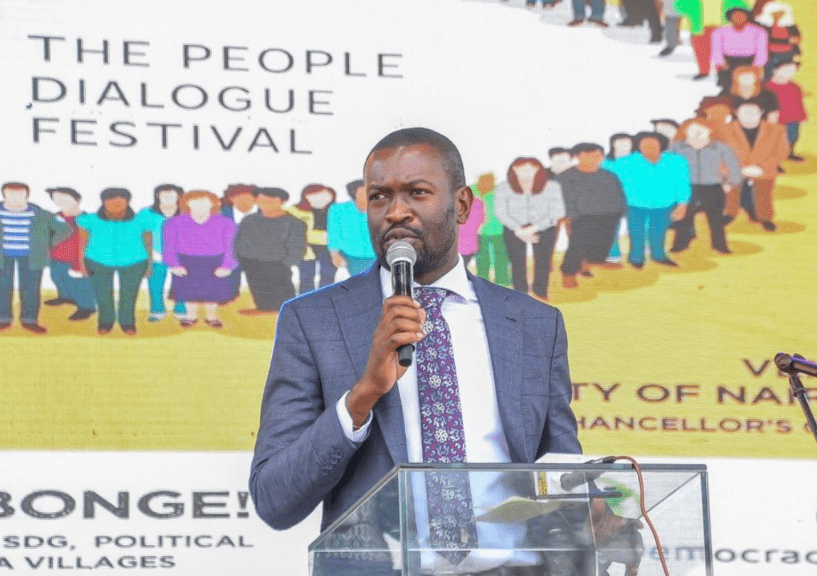

“What this shows is that the debt management policy is all about running on debt and raising the ceiling, it is clear that there are few options for repair of the public balance sheet except more borrowing and extending tenure of debt, debt forgiveness or default,” said Kenya Institute of Economic Affairs Chief executive officer Kwame Owino.

With monthly expenditures of more than Sh225 billion and monthly tax revenues of Sh130 billion, the government is borrowing nearly Sh100 billion to keep its offices open.

The ballooning public debt has surged from Sh1.8 trillion in 2013 to Sh7.6 trillion in 2020 is edging closer to Sh8 trillion.

“At this rate we are looking at a difficult 2021 economically speaking, given that we are spending more than Sh50 billion to pay debt monthly and Sh50 billion on salaries, and only Sh25 billion on development,” said Mohamed Wehliye, a Kenyan who is advisor to the Saudi Arabian Reserve Bank.

Economic activities

Wehliye noted that tax revenues are unlikely to increase this year because there is usually a dip in economic activities the year before elections.

In the last financial year, Kenya Revenue Authorities collected Sh1.6 trillion, but the government expenditure for the year is projected to hit Sh2.7 trillion.

“The problem is not around taxation, the problem is around spending,” said Aly Khan Satchu, the chief executive of Rich Management.

“Until now we have been kicking the can down the road and now there are all the signals that were now coming to the end of the road.”

Borrowing more money

He warned that Kenya keeps the government running by borrowing more money which is why the debt ceiling is being reviewed time and again.

The government yesterday floated a Sh25 billion two-year Treasury Bond and another Sh50 billion sixteen-year Infrastructure Bond signaling growing liquidity pressure at the national coffers.

Central Bank of Kenya (CBK) said in an advert that the Sh25 billion will go towards “budgetary support” while the Sh50 billion will go towards “funding of infrastructure projects in the FY 2020/2021 budget estimates”.

The analysts say the country got into this situation due to increased appetite for funding projects through debt, some without solid feasibility studies.

The new debt target could see Kenya having more than 100 per cent debt to GDP ratio which is common among developed countries. According to analysts, these country manage it due to sufficient cashflow.

“We are talking about liquidity here, it does not matter how much assets you have, what counts is liquidity, if half of your revenues are going to pay debt then it becomes dangerous,” said Wehliye.

National Assembly majority leader Amos Kimunya has showed signs he would support the amendments which may lead to the raising of the debt ceiling. “I would support the raising of the debt ceiling only if the money is to be used for a specific purpose,” said Kimunya.

Global ratings agencies had last month warned that Kenya may struggle to borrow beyond its borders especially on the Eurobond market after Covid-19 complicated its already bad finances.