CBK in large cash reporting dilemma over weak shilling

Central Bank of Kenya (CBK) is in a dilemma on whether the threshold for reporting large cash transactions should be valued in dollar or Kenyan shilling, highlighting policy difficulties facing the country as the local currency weakens.

The Proceeds of Crime and Anti-money Laundering Regulation 2013 requires banks to ask clients to explain the source of funds and intended use and report to the Financial Reporting Centre (FRC) if the $10,000 transaction is deemed suspicious as part of attempts to combat terrorism financing.

When the threshold was set at $10,000 back in January 2016, the amount translated to about Sh1 million since the shilling was exchanging at about Sh100 against the greenback.

The shilling has now devalued by a whopping 44 per cent over those seven years to exchange at Sh144 per dollar, meaning the equivalent threshold for reporting should now be roughly Sh1.44 million.

However, some commercial banks have not made requisite adjustments to match the currency fluctuations, forcing customers to make disclosures on transactions of Sh1 million ($6,944.4), which is currently below the $10,000 legal threshold.

When CBK Governor Kamau Thugge was asked about the matter by the National Assembly’s Finance and National Planning Committee, he said, “allow us to look on that issue and revert.” Meanwhile, other banks are exploiting the policy gap by setting the limit based on the currency a customer is using.

This has left a room where those with dollar-denominated accounts can transact more without being flagged compared to those operating in local currency.

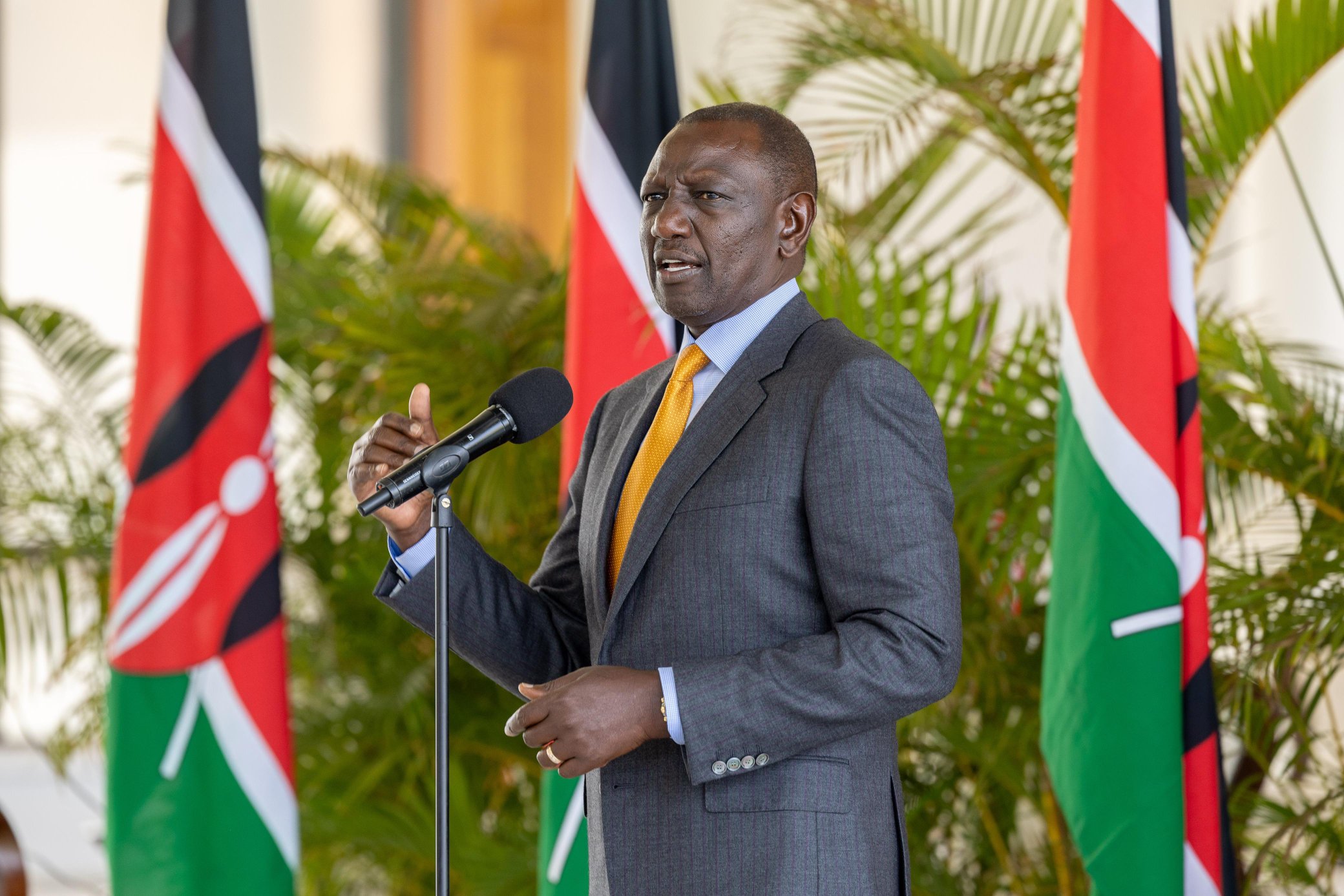

President William Ruto’s cabinet last month approved amendments to the regulation through the draft Anti-Money Laundering and Combating of Terrorism Financing Laws (Amendment) Bill (AML/CFT), 2023 which increased the threshold by 50 per cent to $15,000 (Sh2.16 million).

The Financial Reporting Centre is pushing for watertight anti-money laundering regulations in line with Financial Action Task Force (FATF), the global money laundering and terrorist financing watchdog.

Maximum threshold

“Under FATF, we have actually gone to the maximum threshold. We cannot go beyond the $15,000 unless we want to break the international standards,” Thugge said while also calling for the imposition of fines to further tighten the draft regulation once adopted.

Commercial Banks have, however, opposed the plan to increase the limit, citing significant risk relating to illicit money flow and given Kenya’s geopolitical location in the Horn of Africa. “Due to the increase in the volatility of the exchange rate as well as runaway inflation rates being experienced, the threshold of $10,000 should be retained and applied in a risk-based approach,” Kenya Bankers Association (KBA) noted in a presentation to the committee.

Attempt to raise the threshold flopped in 2021 under the Jubilee government as CBK, under the then Governor Patrick Njoroge, expressed concerns that the decision would expose Kenya to economic sanction.

Kenya is under pressure from the International Monetary Fund (IMF) to seal the existing gaps in its anti-money laundering rules, failure to which the country can be flagged as “high-risk” to terrorism and relateproliferation financing.

The multilateral lender, which has been shaping most of Kenya’s policies due to existing loan agreements, is concerned that the current AML/CFT Bill does not adequately address the identified risks, hence the need to improve effectiveness and supervision. Kenya has up to next month to finalise regulations or risk being grey-listed which could taint the country’s image in terms of attracting more investment inflows.

The grey list now has 26 jurisdictions like South Africa, Nigeria, Mali, Mozambique, Senegal Tanzania, and Uganda.