Bankers urge CBK to retain base rate at 13pc to spur growth

Bankers are urging the Central Bank of Kenya’s (CBK) Monetary Policy Committee (MPC) to maintain the 13 per cent base rate to help the economy navigate these turbulent times.

In its submission to the CBK, the Kenya Bankers Association (KBA) said despite global economic headwinds and waning private sector confidence, Kenya’s economy continues to demonstrate robust growth.

The commercial bankers’ umbrella body noted that headline inflation remains within target, declining to 4.6 per cent in June 2024, the lowest level since October 2020 when it stood at 4.8 per cent.

Private sector credit growth eased to 6.6 per cent in April 2024, down from 7.9 per cent in March 2024. As of July 26, 2024, the interbank rate stood at 13.2 per cent.

The shilling remains stable and has strengthened to exchange against the dollar at Sh132.57 on July 26, 2024, buoyed by strong export earnings and steady inward remittances. However, government financing risks threaten exchange rate stability, delaying potential interest rate reductions.

“Considering these developments and the balance of risks, we argue that maintaining the current monetary policy stance by keeping the CBR unchanged at 13 per cent would be appropriate,” stated the KBA.

KBA joins a list of economic experts calling for the MPC to review the base rate downward. Mid last month, an economic caucus, meeting under the aegis of the Institute of Economic Affairs (IEA-Kenya), urged the MPC to reduce the base rate to 10 per cent, arguing that high rates amid low inflation are stifling growth and recovery.

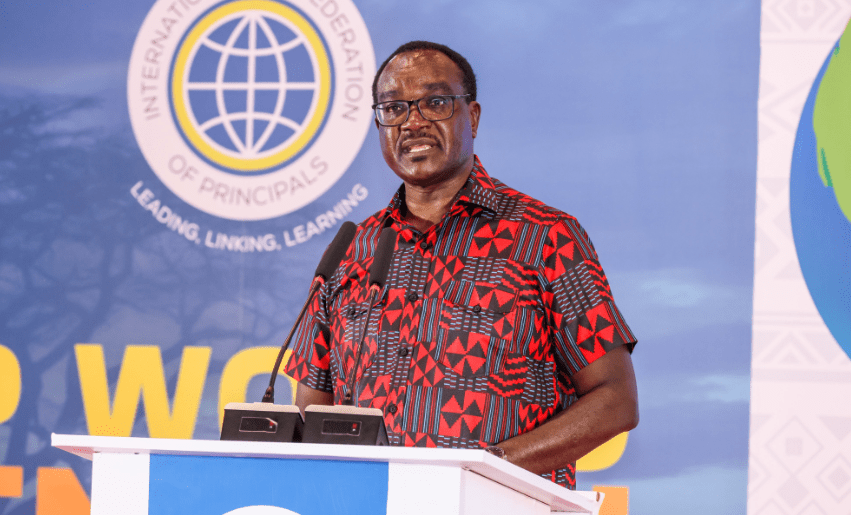

Speaking at the forum, Churchill Ogutu, an economist at IC Group, told the Business Hub that the CBK has been lagging behind current inflation trends.

“Based on that, I can argue that the CBR rates are behind the curve. Look at the inflation outturn even now; it has come back to the target level. It, therefore, solidifies the argument that the next meeting (MPC) next month should result in a cut,” Ogutu said. The MPC is due to meet on August 6, 2024.