President William Ruto’s government yesterday found itself in uncharted waters after the Court of Appeal declared a series of taxes introduced in 2023 unconstitutional, null and void, meaning that it now lacks the key source of financing its budget.

Coming barely weeks after President Ruto had withdrawn the contentious Finance Act 2024 and declared that the government would revert to the Finance Act 2023, the state now finds itself in disarray, with her hands tied on how to finance the almost Sh 4 trillion budget for the 2024/2025 financial year.

Should the government honour the Appellate judgment, it would be a relief for Kenyans as the state would have to reduce VAT on fuel levy from 16 per cent to eight per cent, reduce the monthly contributions to National Social Security Fund (NSSF) and National Hospital Insurance Fund (NHIF) and reduce prices on essential commodities to the rate they were at before the enactment of the 2023 Act.

A three bench judge comprising Justices Kathurima M’Inoti, Agnes Murgor and John Mativo declared that the process to enact the Finance Act, 2023, was fundamentally flawed and violated several constitutional provisions.

The judges cited Articles 220(1) (a) and 221 of the Kenyan Constitution and sections 37, 39A, and 40 of the Public Finance Management Act (PFMA), which outline the budget-making process that the government deliberately violated in its zeal to bulldoze the enactment of the Act.

“Having found that the process leading to the enactment of the Finance Act, 2023 was fundamentally flawed and in violation of the Constitution, sections 30 to 38, 52 to 63 and 23 to 59 of the Finance Act, 2023 stand equally vitiated and therefore unconstitutional,” the judges said in their joint judgment.

The judges went on to state: “Accordingly, we hereby issue a declaration that the enactment of Page 119 of 120 Finance Act, 2023 violated Articles 220 (1) (a) and 221 of the Constitution as read with sections 37, 39A, and 40 of the PFMA which prescribes the budget making process, thereby rendering the ensuing Finance Act, 2023 fundamentally flawed and therefore void ab initio and consequently unconstitutional.”

“Failure to comply with this constitutional requirement renders the entire Finance Act,2023 unconstitutional.”

They said the constitution was violated once the appropriation Bill-Act was approved before the budget proposal had been presented by the CS Treasury in the National Assembly.

Refunding Kenyans

The judges however saved the government from the agony of refunding Kenyans the already collected money in tax forms.

According to the judges, this was denied because it was not pleaded in the petition before the High Court and therefore it was declared to have been before the court improperly. “We uphold the finding by the High Court that concurrence of both houses in the enactment of the Finance Act, 2023 was not a requirement under Article 114,” read part of the ruling.

The judges said the various sections introduced post-public participation to amend the Income Tax Act, Value Added Tax Act, Excise Duty Act, Retirement Benefits Act and Export Processing Zones Act were unconstitutional as they were not subjected to fresh public participation.

Trade unions

The case had been lodged in the High Court by Busia Senator Okiya Omtatah Okoiti, Eliud Karanja Matindi, Michael Kojo Otieno, Benson Odiwuor Otieno, Blair Angima Ogoro, Victor Okuna, Law Society of Kenya (LSK), Azimio La Umoja One Kenya, Kenya Human Rights Commission, Katiba Institute and several trade unions, among others.

The enactment of the Act had elicited 11 constitutional petitions filed by the Senator with over 50 respondents listed including Parliament and the Speaker of the National Assembly.

The decision comes after the Attorney General, Speaker of the national assembly lodged an appeal challenging the decision of the High Court that found that some sections of the Act were illegal.

Essentially, the latest development means that the government would now be forced to go back to the drawing board and look for a new source of funds to finance its activities. To be on the safe legal side, the government will be forced to revert to the Finance Act 2020 to enforce taxation.

The taxes contained in the Finance Act 2023 are separate from another set of revenue-raising measures President Ruto’s administration sought to impose this year that led to deadly protests.

President Ruto had early last month withdrawn the Finance Act 2023, citing widespread protests against the piece of legislation and announced that the government would continue using the Appropriation Act of 2023 to continue accessing money to run its expenditures in light of the development.

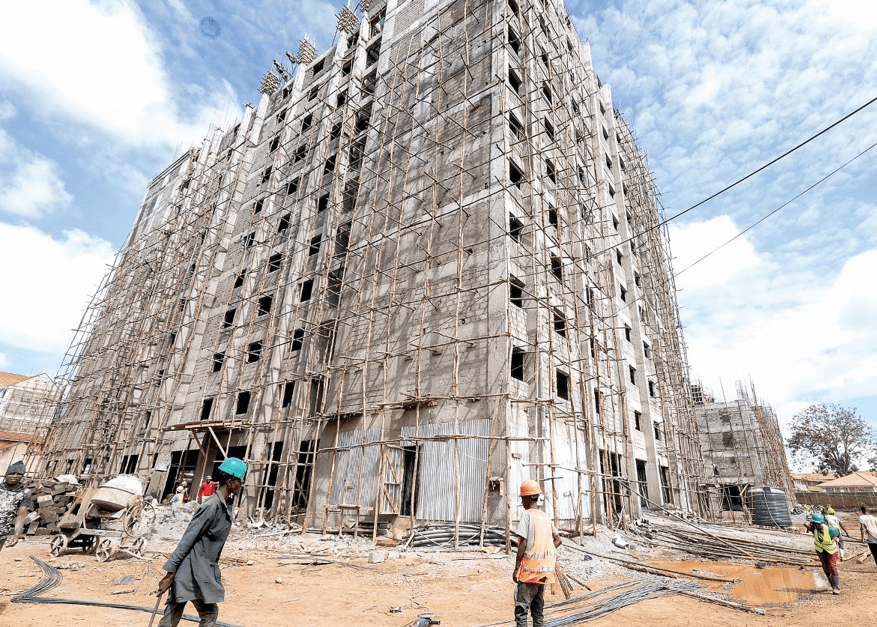

The now declared null and void Finance Act 2023 had set in motion a tax regime as the Kenya Kwanza administration pursued a policy to mobilise revenue through deliberate increment of tax rates, expansion of tax base and collection of tax in real-time.

The proposals in the Bill were significant and impacted several taxpayers’ businesses as the National Treasury continued to pursue a policy of revenue mobilisation by increasing tax rates, expanding the tax base, and collecting taxes in real-time.

The Act had been enacted after amendments to the Income Tax Act (“ITA”), Value Added Tax Act, 2013 (“VAT Act”), Excise Duty Act, 2015, Tax Appeals Tribunal Act (“TAT Act”), Tax Procedures Act (“TPA”), the Miscellaneous Fees and Levies Act, 2016 (“MFLA”), Betting, Gaming and Lotteries Act, Kenya Road Board Act, 1999, Kenya Revenue Act, 1995, Employment Act, 2007, Retirement Benefits Act, Unclaimed Financial Assets Act, 2011, and the Statutory Instruments Act, 2013 as the government sought to fund a Sh 3.6 trillion 2023/2024 budget.