How annual loss of $40b undermines Africa’s growth

Illicit financial flows and corporate tax abuses continue to siphon wealth from Africa, costing the continent approximately $40 billion annually, experts warn.

This emerged during a Nairobi meeting bringing together African civil society actors to strengthen advocacy for sustainable climate finance reform.

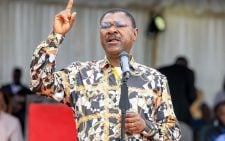

Chenai Mukumba (pictured), Executive Director of Tax Justice Network Africa (TJNA), noted that illicit financial flows and corporate tax abuses continue to siphon wealth from Africa thereby exacerbating the challenges of achieving economic justice, climate adaptation, and sustainable development.

“Of the many illicit financial flows affecting Africa, corporate tax avoidance from mining alone costs the continent about $730 million annually. The cumulative revenue lost to IFFs undermines governments’ abilities to deliver essential services such as healthcare, education, and infrastructure,” she said.

Mukumba emphasised that African countries must re-evaluate their extractive industries’ management to counter these injustices.

This approach involves structural reforms across the entire value chain, from mining governance to transparent revenue management.

Regional co-operation is equally crucial to counter corporate tax abuses; by aligning policies, African countries can bolster their bargaining power with multinationals and enhance revenue collection.

Alternative financing methods, such as carbon markets and green bonds, were also recommended to support sustainable development.

Extractive industries

Dean BheBhe, Campaigns Lead at Power Shift Africa, underscored the fact that the extractive industries contribute significantly to many African economies, often accounting for nearly a third of government revenue.

However, he highlighted a “triple injustice” faced by mine-hosting communities, where resource exploitation amplifies tax and climate injustices. Current estimates suggest corporate tax avoidance is now equivalent to two to three percent of Africa’s gross domestic product (GDP), indicating the urgent need for tax reform grounded in equity and justice.

The TJNA-organised meeting aimed to establish principles for sustainable natural resource governance and advocate for climate and tax justice.

It also promoted climate-focused national tax measures to support equitable growth and environmental resilience across Africa.