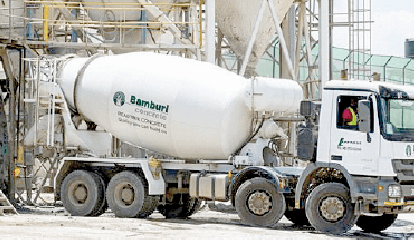

Bamburi faces earnings dip on Uganda unit sale

Bamburi Cement Limited has issued a profit warning for the financial year ended December last year, citing issues related to its Ugandan subsidiary, Hima Cement Limited.

A notice published yesterday says the company stares at a significant downturn in its financial performance, with net earnings expected to fall by 25 per cent to Sh135 million from the Sh181 million reported in the fiscal year 2022.

The company’s chairman John Simba attributed the anticipated decline primarily to a one-time settlement of substantial tax liabilities and legal disputes in Hima Cement Ltd as part of the closure of the sale transaction.

“The resolution of these longstanding issues, which have arisen from transfer pricing compliance reviews spanning several years, is expected to have a considerable impact on Bamburi’s financial outcomes, he said.

As a result, the board has advised shareholders, potential investors, and the public to prepare for a dip in the 2023 net earnings. Preliminary assessments indicate a projected decrease of at least 25 per cent compared to the previous fiscal year’s earnings.

In the recent past, Bamburi Cement faced tax claims amounting to Sh1.2 billion by authorities in Kenya and Uganda.

In Uganda, where it operated through its subsidiary Hima Cement Limited, the company was served with a demand for taxes totalling Sh956 million.

These tax liabilities arose from a review of Hima Cement Limited’s transfer pricing compliance for the financial years of 2014 to 2018. In a strategic move, Bamburi Cement completed the sale of its 70 per cent stake in its Ugandan subsidiary Hima Cement for an estimated $84 million (Sh12 billion). The sale was made to a consortium of Sarrai Group and Rwimi Holding.

This transaction was part of a strategy by Bamburi’s parent firm Holcim to divest from fragmented markets and concentrate in countries where it is among the biggest players.

The multinational is simultaneously selling its 65 percent stake in its Tanzanian subsidiary Mbeya Cement Company to Amsons Group for an undisclosed sum.

“These divestments advance our strategy to consolidate our leadership in core markets as the global leader in innovative and sustainable building solutions,” Martin Kriegner, Holcim’s Regional Head of Asia, Middle East & Africa said in a statement. This strategic shift is expected to have a significant impact on Bamburi’.