Mobile money subscribers dip 1.6pc in second quarter

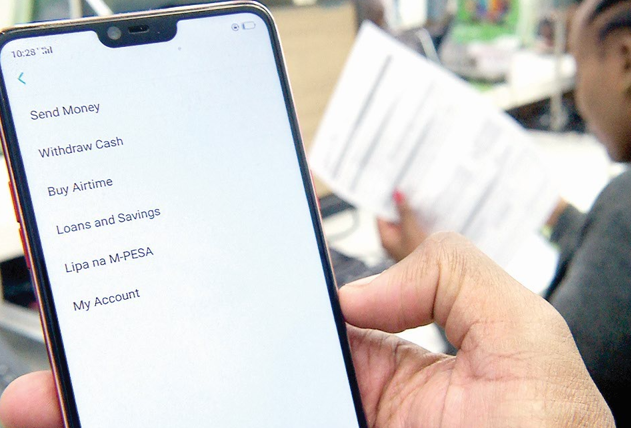

Kenya’s mobile money subscriptions experienced a slight decrease of 1.55 per cent from 38.6 million to 38 million in the second quarter of fiscal year 2023/24, indicating a shift in consumer behaviour and usage patterns of mobile money services.

Communications Authority of Kenya (CA) reported this trend in their latest data release for the financial year 2023/24 which has also highlighted a corresponding drop in the mobile money penetration rate to 75.1 per cent.

“As of 30th December 2023, mobile money subscriptions dropped to stand at 38 million, translating to a penetration rate of 75.1 per cent. The decline is attributed to the drop in the number of mobile (SIM) subscriptions,” CA said.

During the review period, mobile subscriptions fell by 0.6 per cent from 67.1 million to 66.7 million. This decrease was due to more customers leaving than joining, particularly for Telkom Kenya Limited.

In December 2022, there were 38.6 million mobile money subscriptions. As the year progressed, this number slightly decreased to 38.4 million by March 2023. From June 2023, the subscriptions remained constant at 38 million, according to the authority.

Similarly, CA said the mobile money penetration rate, which is the percentage of the population using these services, started at 78.2 per cent in December 2022 and gradually dropped over the year, stabilising at about 75.1 per cent from June 2023.

According to CA, prepaid plans still dominate, accounting for 65,492,294 out of the total 66,745,709 subscriptions. This leaves just a small fraction, 1,253,415, for postpaid plans.

Safaricom, the market leader, boasts 44,013,156 subscriptions out of which 42,875,208 are prepaid, with the remaining 1,137,948 being postpaid. Airtel, the second-largest provider, mirrors this trend with 19,282,993 of its 19,387,460 subscriptions being prepaid and a mere 104,467 postpaid.

Network coverage

Telkom and JTL have almost all of their 1,343,276 and 498,068 subscriptions respectively prepaid, while Equitel, with its 1,503,749 subscriptions, is entirely prepaid.

The minimal uptake of postpaid plans could be attributed to factors such as pricing, network coverage, and customer preference.

Safaricom retained its dominant market share, with 65.9 per cent in mobile (SIM) subscriptions. Airtel trailed behind with 29 per cent market share, while TKL, Finserve, and JTL’s market shares stood at 2 per cent, 2.3 per cent, and 0.7 per cent respectively.

When it comes to payment services, M-Pesa, a mobile money service, reigns supreme with a 97.1 per cent market share, followed by Airtel and T-Cash with 2.9 per cent.

During the reference period, it was observed that 4G technology has become increasingly popular among mobile data service consumers. It accounted for 51.5 per cent of all mobile data subscriptions.

Furthermore, the data volumes consumed within the 4G network made up a significant 82.7 per cent of the total data volumes.

The CA data also indicates that in Kenya’s mobile market, total subscriptions exceed the sum of 2G, 3G, 4G, and 5G subscriptions, pointing to multiple subscriptions per user.

4G is popular with the second highest subscriptions at 97 per cent, while 2G and 3G maintain a significant share both at 98 per cent.