State eyes tax incentives to woo investors from China

Kenya will use various tax inducements to woo Chinese investors to help drive the economic recovery agenda, a government official has said.

Pius Rotich, General Manager of Investment Promotion and Business Development at Kenya Investment Authority (KenInvest) said the government will extend “necessary” priority to potential investors with over 300 local investment opportunities.

“As a government we will seek to remove all the bottlenecks that scare investors and tax incentives is always one of the best ways to attract investments, but that has to be undertaken with the help of the national treasury,” he said.

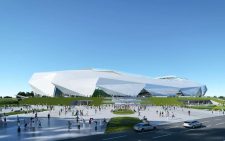

Rotich was speaking ahead of this year’s edition of the Kenya International Industrial Expo set for November 3 in Nairobi. The event at Sarit Centre is expected to tap 130 Chinese firms and 20 Kenyan companies.

Driving growth

Themed “Driving Growth in Kenya’s Manufacturing Sector through Technology and Partnerships” – the three-day exhibition will for the first time see more Kenyan firms attempt to secure deals with Chinese firms compared to the previous editions.

“Afripeak has allocated a bigger space for Kenyan Pavilion that will accommodate 20 local companies presenting their products on this international platform and offering an opportunity to link to potential overseas buyers,” said Gao Wei, the managing director of Afripeak expo Kenya.

Investors can leverage tax provisions by Kenya Revenue Authority (KRA) which says an investor who incurs capital expenditure on building or machinery used for manufacture is entitled to an investment deduction equal to 100 percent of the cost.

The preferential tax terms include value added tax (VAT) exemption on all supplies of goods and services to enterprises, reduction in corporate tax to 10 per cent from 30 per cent for a period of 10 years of operation and 15 per cent for a period of 10 years.