Uhuru defends Kenya’s huge appetite for loans

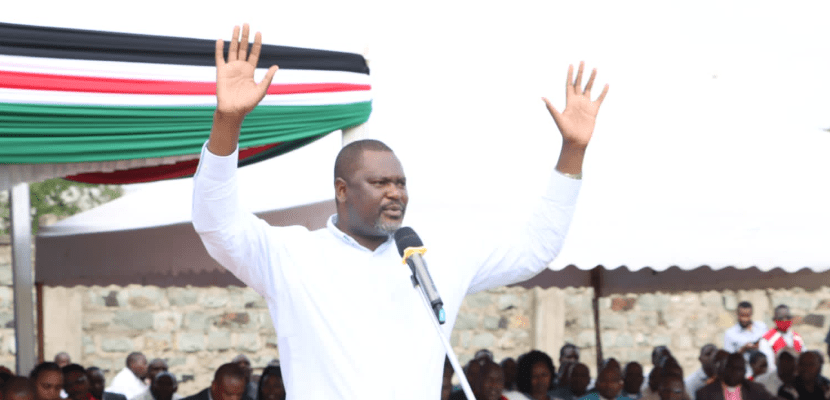

President Uhuru Kenyatta has maintained that the government borrowing is sustainable despite increased public concerns.

While defending the huge infrastructure projects that accounted for the majority of debt the country has accumulated during his nine-year term, the president said that borrowing for development is the trend across the world. Despite Kenya’s non-concessional loans having raised fiscal vulnerabilities and interest payments to nearly 20 per cent of revenues, he maintained that it’s through the loans that Kenya grew its wealth of our nation from a gross domestic product (GDP) of Sh4.5 trillion in 2013 to close to Sh13 trillion in 2022.

“I pose to the nation; How much is too much borrowing? When does it become unbearable to a nation? The only time debt is a burden to a nation is if a nation is led by looters. We should not shy away from using other people’s money,” President Kenyatta said.

Kenya’s public debt hit Sh8.02 trillion ($70.97 billion) in December 2021 with debt repayments accounting to one third of countries budget.

However, President Kenyatta opted to focus on the economic growth that the country has achieved saying that the country is projecting to collect Sh2 trillion by the end of the current financial year.

“As a mark of this remarkable growth, our tax revenues have doubled from Sh800 billion in financial year 2012/13 to Sh1.662 trillion as at April 2022,” he added.

While acknowledging that corruption is still a challenge in the country, Uhuru pointed out that the devil of corruption is still alive and well in Kenya. “Firstly, you cannot do the big push investments in dams, roads and rail in an environment of corruption,” he added.

Infrastructure projects

According to Treasury budget estimates for the 2022/23 fiscal year show that slightly more than half (Sh15.62 billion) of the projected loans in the coming year will still be injected into infrastructure projects under the Ministry of Energy, largely power transmission infrastructure and Infrastructure Department [largely roads] which will get Sh5.73 billion. Already the National Treasury has proposed an increase in debt ceiling from the current Sh9 trillion to Sh10 trillion in order to enable the government to borrow more to finance the Sh3.33 trillion budget for the 2022/23 financial year.

However, the push to raise debt ceiling to Sh10 trillion has elicited strong reactions from analysts and political leaders.

Coming amid rising cost of living and a head of a General Election, the economy is taking centre stage, with Kenyans saying Treasury is overstepping its mandate.

“We don’t need a debt ceiling. Abolish it! We need a ceiling on the annual deficit,” said Mohammed Wehliye, advisor to the Central bank of Saudi Arabia.

Treasury is seeking to fall back on debt to plug an Sh800 billion budget deficit after having raised taxes in six different areas with MPs only rejecting four tax proposals despite pressure from the private sector.

Kenyans on social media faulted Treasury for lack of transparency as citizens don’t know the current value of the country’s debt as the current data puts debt at Sh8 trillion instead of Sh9 trillion.